Experienced retail traders and long-term investors in the cryptocurrency market understand the driving force in a speculative market algorithm fueled by people and not capital. Decisions and investment plans to buy large amounts of cryptocurrency assets are carried out by individuals with top information and a better idea of the price performance of such assets.

These factors affect how many beginner traders trade, coupled with the uncertainty of price fluctuations, which can significantly affect human psychology and make it extremely difficult to execute profitable trades.

Many users have turned to robots or AI-driven technology to help execute trades. Still, the best winners in the financial market are trades driven by sentiment, and whales are accumulating either short-term or long-term.

For the above reasons, retailers and beginner traders look for better trading opportunities or strategies to optimize their trading experience and increase the profitability of their investments.

In this article, we will discuss how to discover what crypto whales are buying and leverage on Maegex copy trading to remain profitable while doing little in the cryptocurrency market.

Crypto Whales – Who Are They?

Crypto whales are individuals or institutions that accumulate many cryptocurrency tokens with good tokenomic and have the prospect of generating good profit returns within months or years.

Whales first originated from the traditional financial (TradFi) market, referring to investors and institutions that influenced the price of the market and carried out huge transactions. The same applies to the cryptocurrency market, as crypto whales accumulate large amounts of cryptocurrency tokens, influencing sentiments regarding those assets.

Although there are no criteria on the number of cryptocurrency assets to be accumulated to earn the crypto whale term, these individuals or institutions have a large amount of these assets that will move the price of these cryptocurrency assets either upward or downward price movement.

The digital age has made the need to track the portfolio of crypto whales essential, as this will greatly improve the profitability of the trader. However, tracking these portfolio assets requires time and knowledge of using high-tech applications and constantly searching for new and improved technologies to remain profitable.

Tool Used to Track Crypto Whale Movement

Crypto whales have the influence to manipulate and create a sentimental shift in cryptocurrency assets, leading to a domino effect, either to the upside or downside, depending on the sentiment surrounding the buy orders or sell orders of a particular crypto asset.

Whales possess the power to create demand or supply sentiment through their trading activity, which leads to huge potential returns for traders. Retailers explore tools to track these buy or sell activities to make informed decisions.

AI tools such as Nansen, Eherscan, Dune analytics dashboard, and others are used to track crypto whale activities and trading patterns. However, for better results, this software could require a subscription.

The Nansen AI tool above shows different data on a cryptocurrency token and the amount bought by different crypto whales within a specific period. This will help users and retailers decide to favour their profitability by tracking these so-called smart money traders or investors.

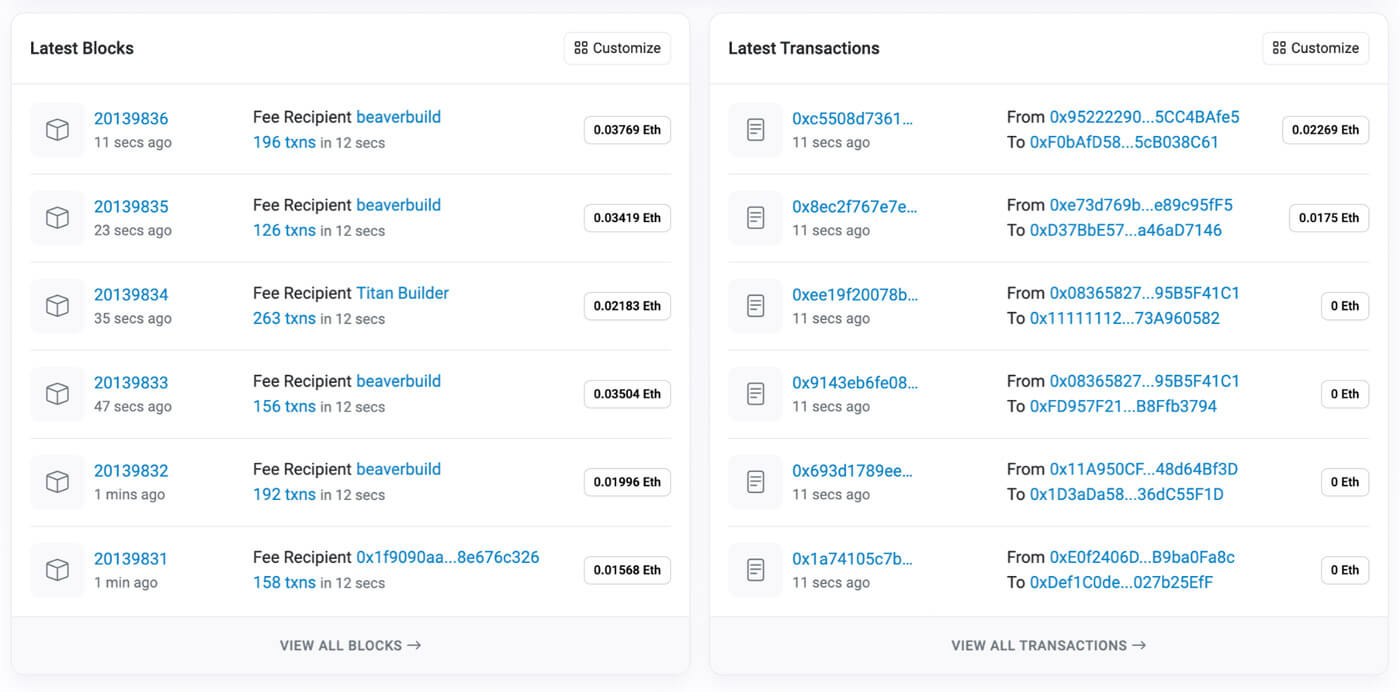

Another example of a tracking tool for big wallet token holders is the user Etherscan, which displays all transaction activities on the Ethereum network. This enables users to track different transactions performed by crypto whales and the specific token transactions they have been involved in.

Tools like Solscan and Snowtrace track tokens on the Solana and Avalanche networks. These tools help users or traders stay ahead of the market trend curve and make profitable gains.

To use these crypto whale tracking tools effectively, one needs to acquire cryptocurrency skills, understand how these tools work and combine these tools with other software to properly track these crypto whales or use a paid subscription plan for other AI tools.

All of these reasons make the Margex automated copy trading tool more effective. It takes the load off many users and traders as it enables them to build a better profitable trading journey while having enough time to focus on building a sustainable strategy and diversifying their portfolio.

Margex Automated Copy Trading Tool for All Beginners And Pro Users

Automation continues to evolve in the financial market, as many users and traders do not have the luxury of sitting in front of the charts all day waiting for setups to play out, entering a trade and suffering losses as a result of manipulation, or not entering the right trending cryptocurrency asset.

Copy trading helps eliminate the stress needed to track crypto whale wallets, with far more such guarantees for many users who have explored the use of copy trading tools. Copy trading, as the name implies, is the use of an automated strategy tool to replicate or mirror the trades of other experienced traders.

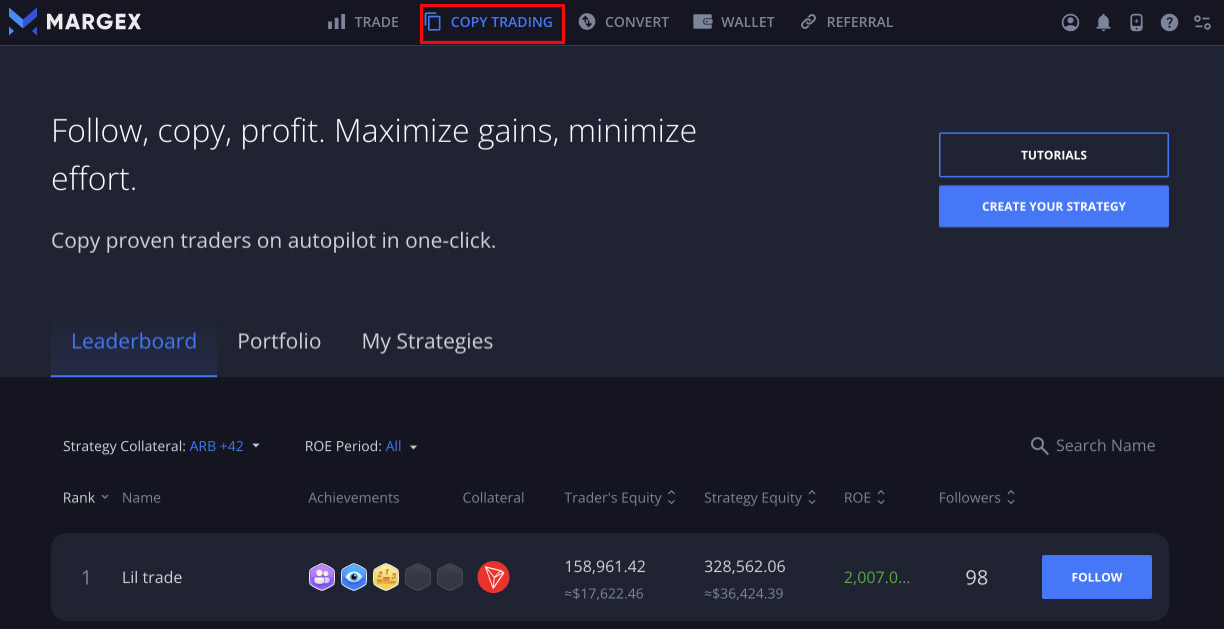

To lift the load work and help users scale better in their trading journey, Margex Exchange, a copy trading platform, has designed its platform to provide the best trading experience to all users, enabling seamless copy trading on its user interfaces.

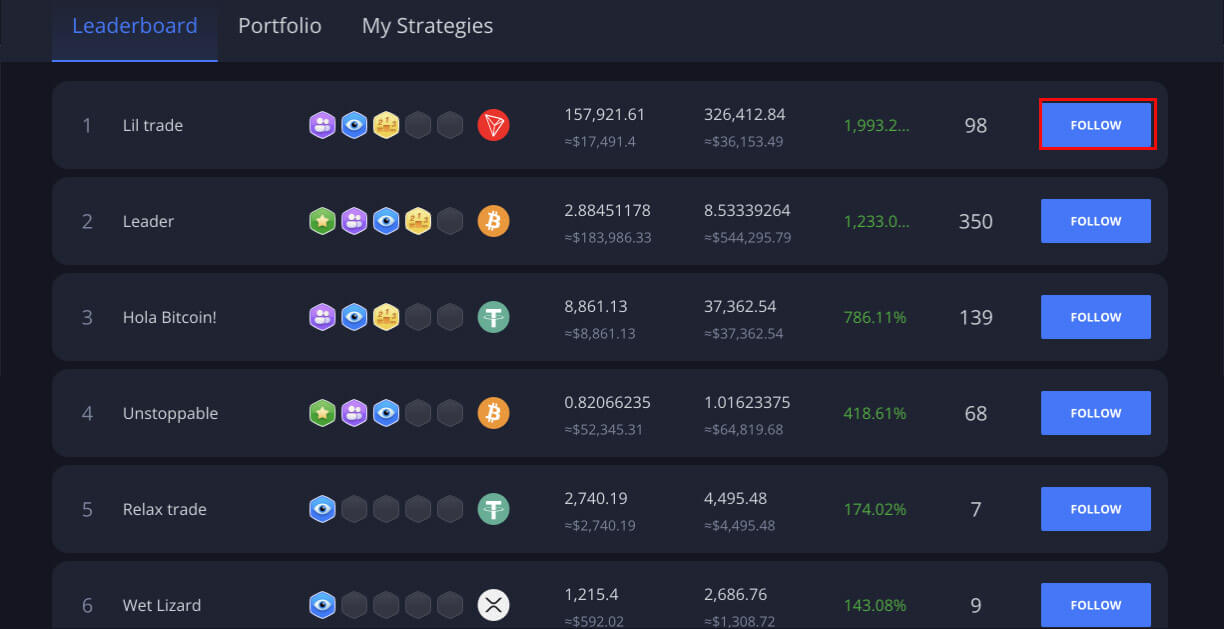

With a robust, ultra-convenient, and user-friendly platform, users have access to top experienced traders to copy from and analyse past trading data of these traders, such as cumulative equity in position, return on equity (ROE), strategies, most traded assets, and all.

These features enable users to make the best trading decisions, choose an experienced trader to copy, and start their copy trading experience. To further improve the trading experience for its global community, Margex also included a zero-fee converter and different modes of deposit and withdrawal.

Margex zero-fee converter helps users swap different crypto assets with ease, improving their experience on the platform. Due to their low transaction fees and high speed, users can also use different means of withdrawal and deposit, such as USDT, USDC, and Kaspa.

Margex is also currently offering its high-volume users the opportunity to earn a share of up to $5 million in Hamster Kombat (HMSTR) airdrop tokens from June 24, 12:00 UTC, to July 14, 12:00 UTC, 2024.

Eligibility for a share in Hamster Kombat (HMSTR) airdrop tokens is as follows;

$100,000 – $10 in Hamster Kombat (HMSTR) tokens

$250,000 – $20 in Hamster Kombat (HMSTR) tokens

$500,000 – $30 in Hamster Kombat (HMSTR) tokens

$1M – $50 in Hamster Kombat (HMSTR) in tokens

$5M – $250 in Hamster Kombat (HMSTR) tokens

$10M – $500 in Hamster Kombat (HMSTR) tokens

$25M – $1,500 in Hamster Kombat (HMSTR) tokens

$50M – $3,000 in Hamster Kombat (HMSTR) tokens

$100M – $5,000 in Hamster Kombat (HMSTR) tokens

You can kickstart your copy trading journey with as low as $10 on the Margex platform using these simple steps below;

1 Select A Trader

Login to the Margex copy trading platform to access the copy trading dashboard. This will allow you to select a trader and strategies you wish to copy trade. All data to halp you make an informed decision about a trader is on the dashboard.

2 Click Follow

On the copy trading dashboard, users can click follow to to automate their copy trading experience. Create their strategies before deciding on an amount to deposit. Users are allowed to follow multiple experienced traders to enable portfolio diversification.

3 Allocate an amount for trading

Deposit an amount you wish to use for your copy trading strategy.

4 Confirm copy trading

Confirm the above steps to open the way to profitability in your copy trading journey.

The post What Are the Crypto Whales Buying? How to Stay Ahead of The Curve with Margex Copy Trading appeared first on CryptoSlate.

Post a Comment