Quick Take

Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) accumulated an impressive $948.3 million over five consecutive trading days. This remarkable streak marks the first time such a feat has been achieved from March 11 to March 15.

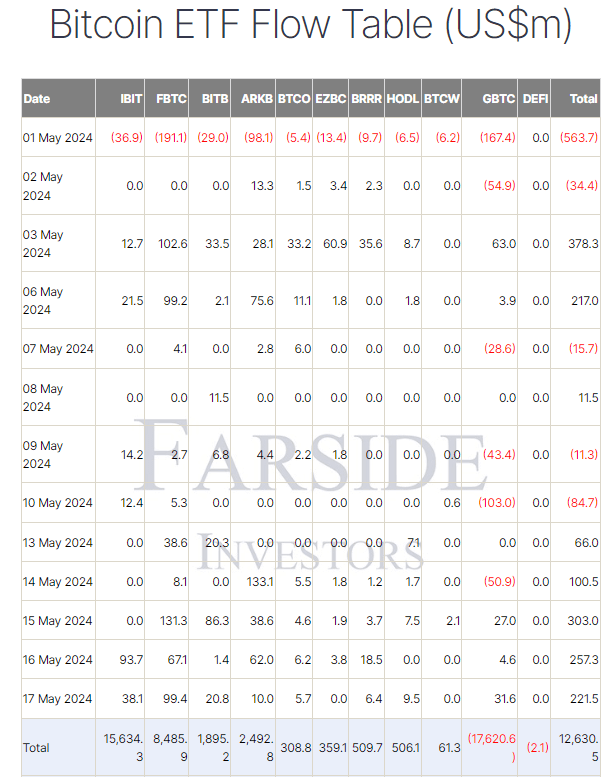

Farside data shows that on May 17 alone, the BTC ETFs witnessed a staggering $221.5 million in net inflows, with eight out of the 11 ETFs recording positive inflows. Fidelity’s FBTC led the charge, attracting $99.4 million, bringing its total net inflows to a remarkable $8.5 billion. BlackRock’s IBIT followed closely, with a $38.1 million inflow, taking its total net inflows to $15.6 billion. Grayscale’s GBTC also continued its positive momentum, recording a $31.6 million inflow, marking its third consecutive day of inflows. Despite this, GBTC’s total outflows stand at $17.6 billion. Collectively, the ETFs have amassed a net total of $12.6 billion.

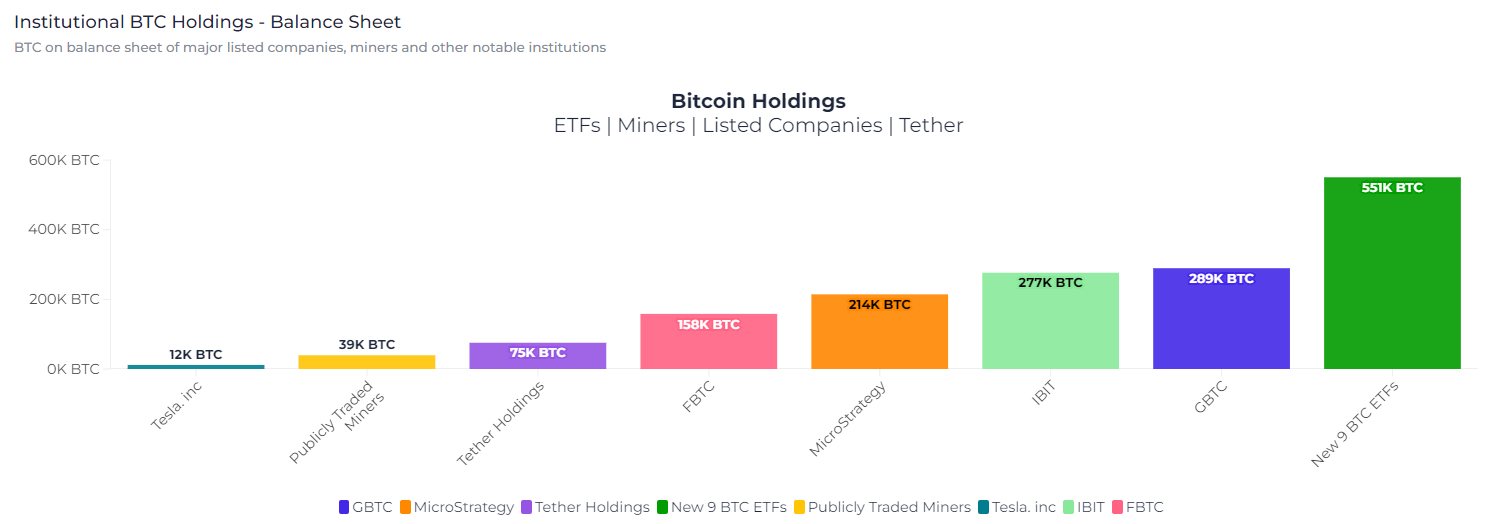

According to data from heyapollo, the nine new BTC ETFs have surpassed 550,000 BTC in holdings, while Grayscale’s GBTC holds roughly 289,000 BTC.

The post U.S. Bitcoin ETFs notch $948.3 million in accumulation over five days appeared first on CryptoSlate.

إرسال تعليق