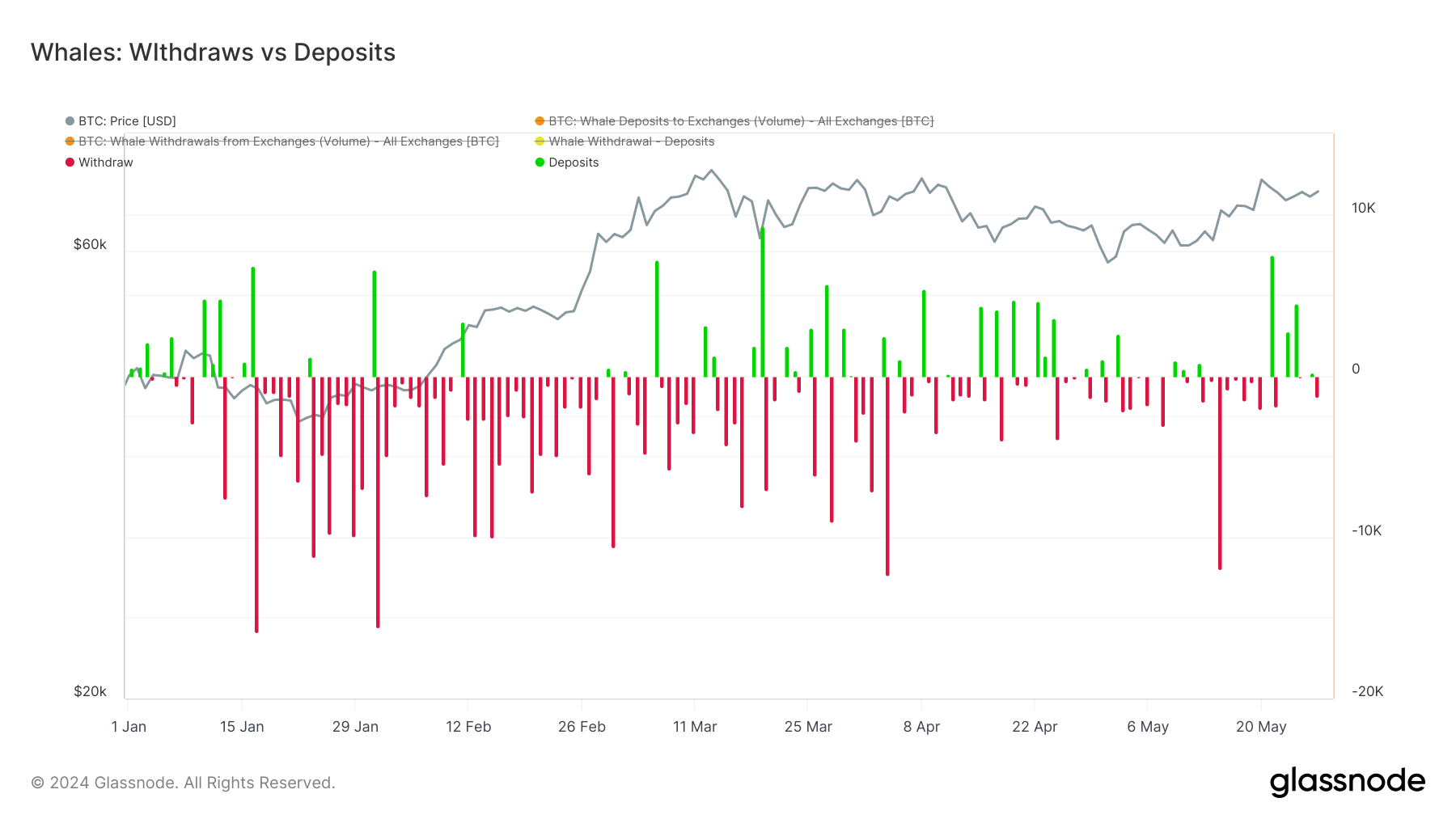

Glassnode defines Bitcoin whales as the number of unique entities holding at least 1k coins. Year to date, these whales have primarily been making withdrawals, influenced by Bitcoin US ETFs. Notably, in the past ten trading days, there have been significant outflows from US ETFs, but a new trend has emerged: whale deposits onto exchanges.

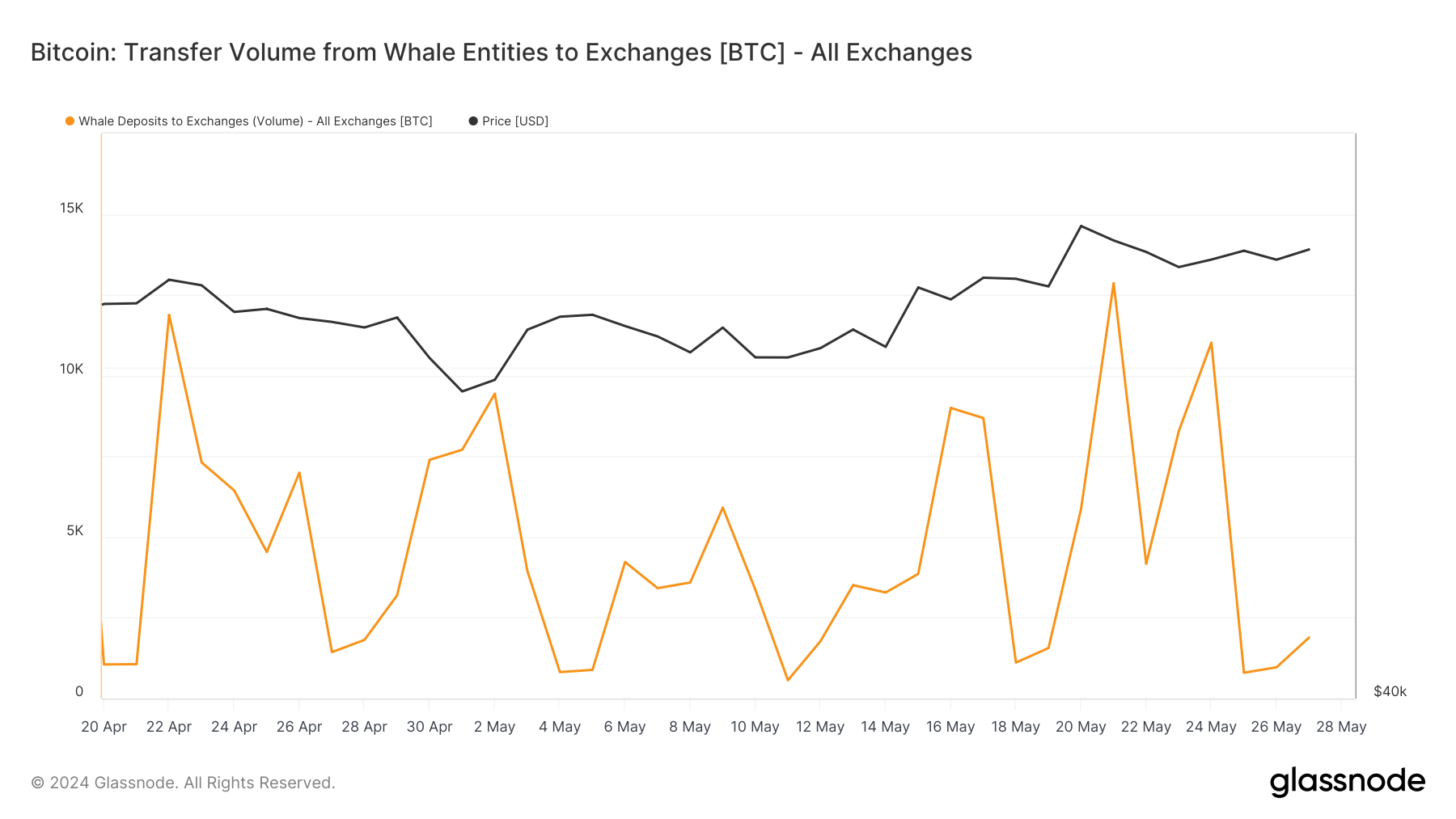

According to Glassnode data, around 13,000 BTC were deposited starting May 21, with additional large deposits on May 24 and 25. These deposits coincide with Bitcoin’s price rally, indicating that whales are selling into price strength. This is a crucial trend to monitor.

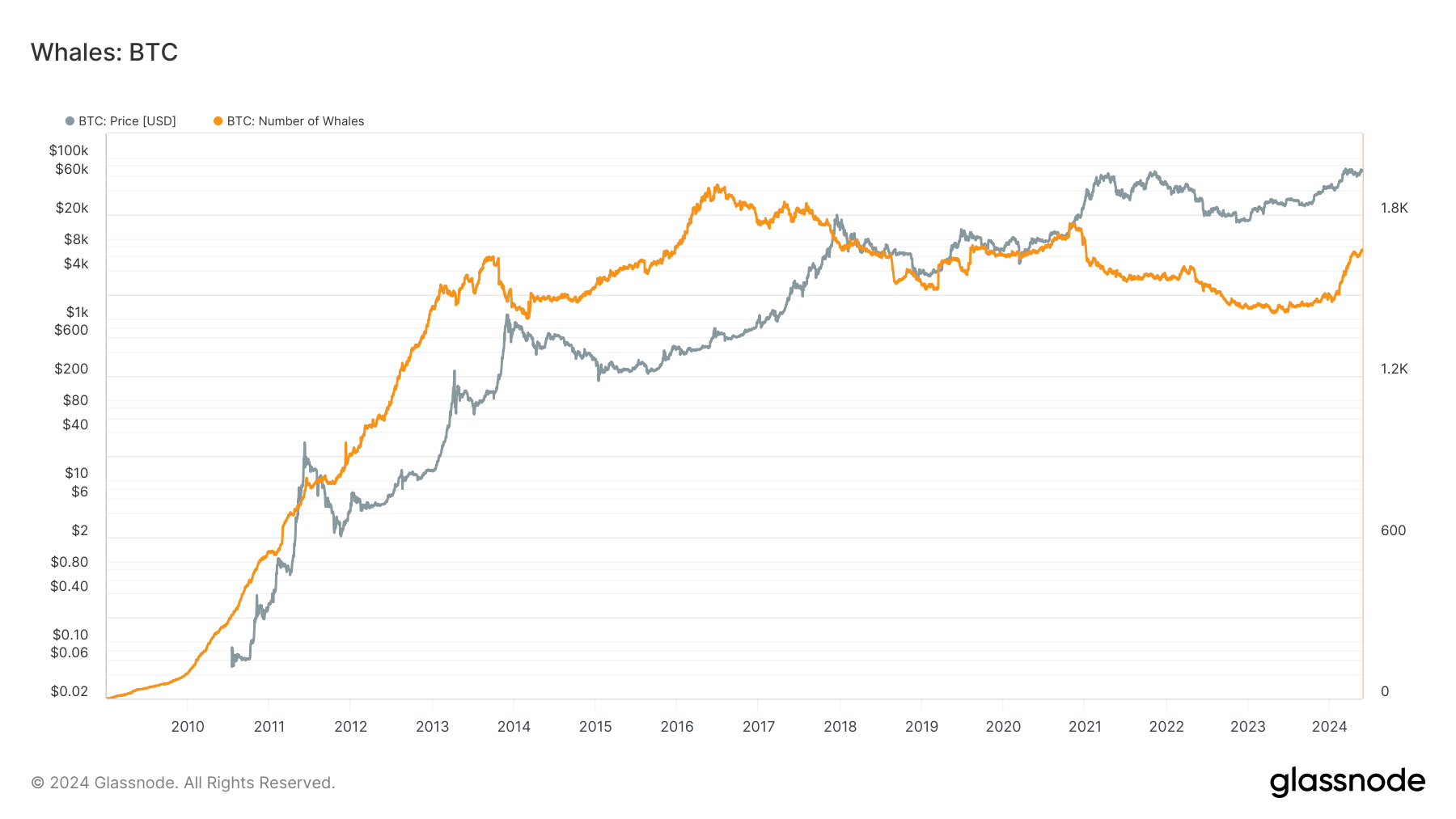

Despite these activities, the number of unique entities holding at least 1,000 BTC has continued to rise, reaching 1,668.

It is essential to note that wallets with balances over 1,000 BTC often include ETFs such as Grayscale, which spreads its Bitcoin across multiple addresses. ETFs with assets under management exceeding $68 million now fall into the whale category.

The post Sharp rise in Bitcoin whale deposits amid ETF outflows appeared first on CryptoSlate.

Post a Comment