Quick Take

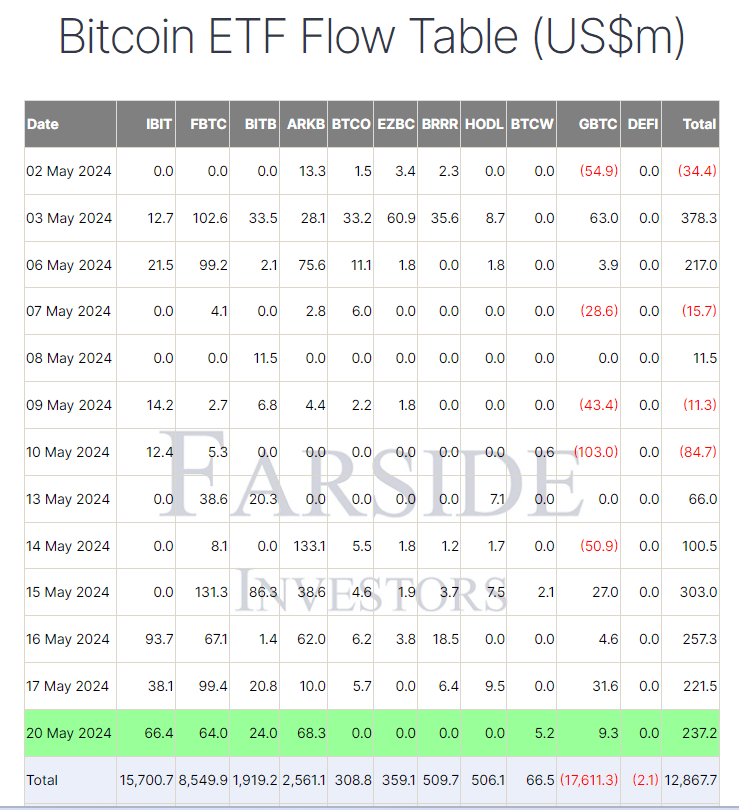

Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) saw a staggering $237.2 million inflow on May 20. Six of the 11 ETF issuers experienced significant inflows, with Ark ARKB leading the pack with a $68.3 million inflow, bringing its total net inflow to an impressive $2.6 billion. BlackRock IBIT followed closely with a $66.4 million inflow, taking its total net inflow to a substantial $15.7 billion. Fidelity FBTC also witnessed a $64.0 million inflow, raising its total net inflow to $8.5 billion.

Grayscale GBTC, despite facing a total net outflow of $17.6 billion, managed to attract a $9.3 million inflow on May 20. The total net inflows for ETFs now stand at $12.9 billion, according to Farside data.

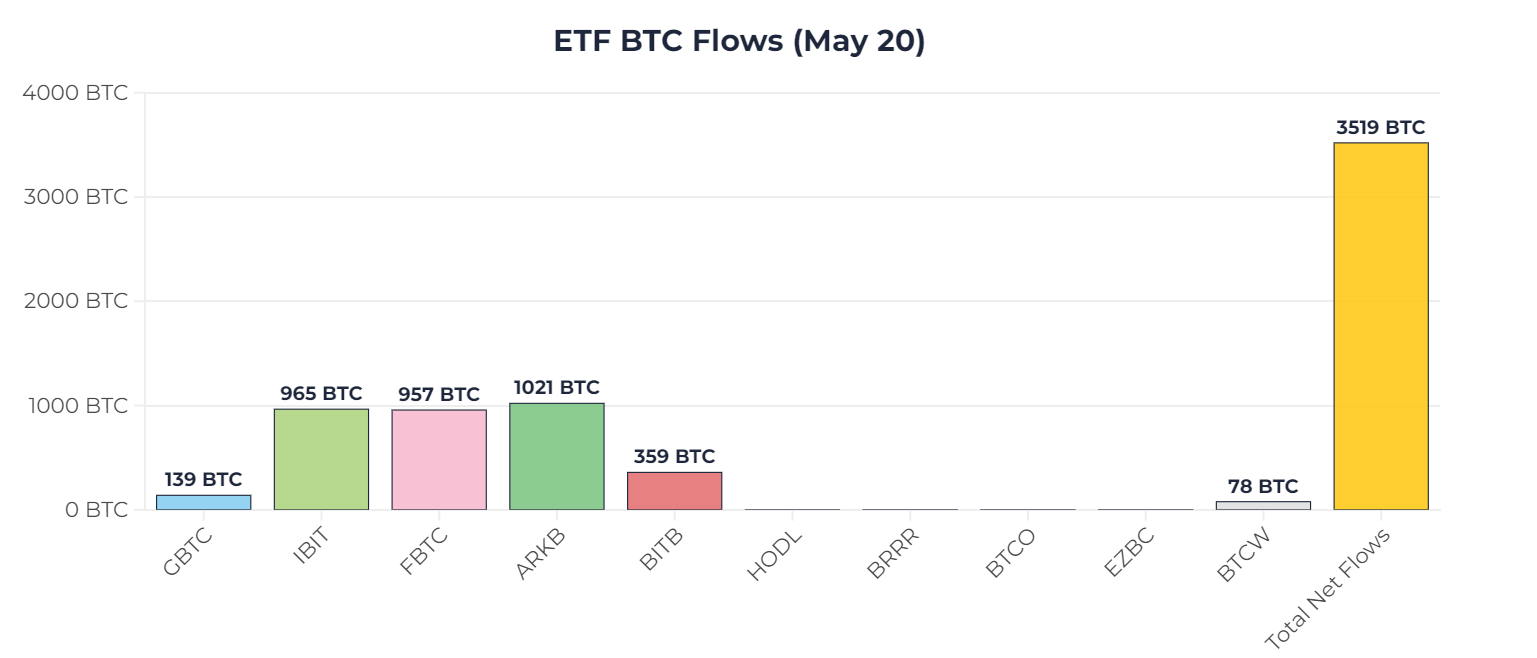

Data from heyapollo, the BTC ETFs accumulated a remarkable 3,519 Bitcoin on May 20, which is approximately eight times the daily mined supply of around 450 BTC.

Bitcoin is around $71,000, reflecting an 8% increase over the past five days.

The post Bitcoin ETFs see $237 million inflow on May 20, led by Ark and BlackRock appeared first on CryptoSlate.

إرسال تعليق