Recent legal challenges with US authorities have resulted in a noticeable decline in user assets on KuCoin, according to the exchange’s latest proof-of-reserve certificate.

According to the update, the exchange users’ Bitcoin holdings decreased 25.4% to 12,114 BTC in March, while Ethereum balances plummeted by approximately 22% to around 112,000 ETH. Similarly, the amount of Tether’s USDT held by users on the exchange dropped by about 22% to 963 million USDT tokens.

Data from DeFiLlama further corroborates this downtrend, as over $843 million worth of digital assets were withdrawn from the platform during the past week. This resulted in KuCoin’s balance dwindling to $3.2 billion from the over $4.3 billion recorded as of March 26.

However, despite these declines and outflows, the exchange’s proof-of-reserves certificate shows that the firm has fully backed assets within its system. Based on the report, the collateralization of the tokens ranged from 109-115%.

KuCoin’s recent challenges can be attributed to the back-to-back lawsuits it faced from the US authorities, including the US Department of Justice and the Commodity and Futures Trading Commission (CFTC), last week. The authorities alleged that the platform violated anti-money laundering regulations with its unregistered operations within the country.

Market share decline

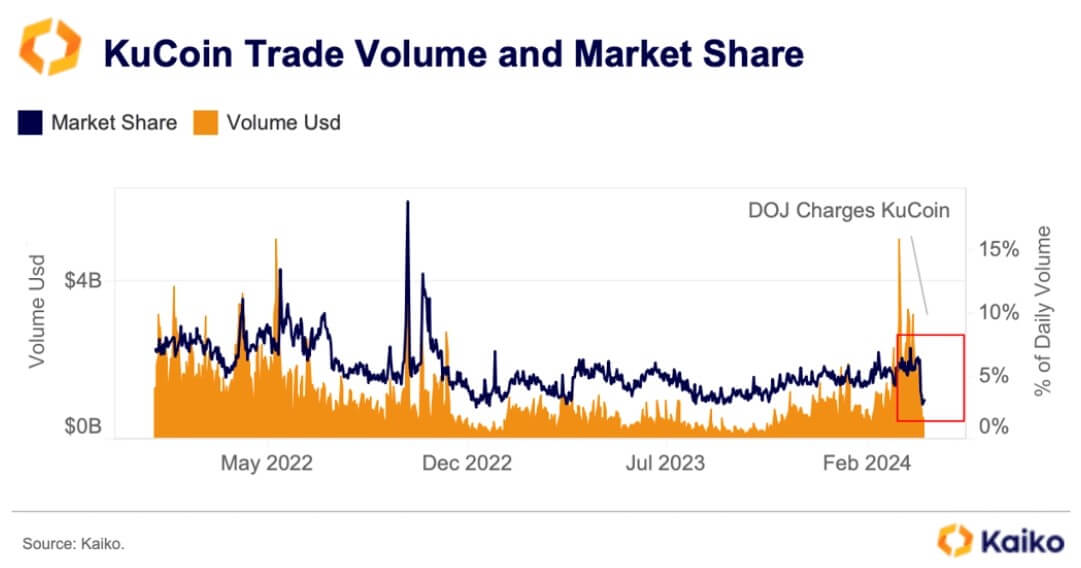

Simultaneously, KuCoin’s market share and trading volume have significantly declined during the past week.

According to Kaiko data, the exchange’s daily trading volume plummeted to around $520 million from approximately $2 billion, with the exchange’s market share dropping from about 6.5% to less than 3%.

Kaiko reported that the exchange users transferred their assets to rival centralized exchanges like Coinbase, Binance, and OKX. It added:

“Some of the outflows can also be attributed to market makers leaving the exchange. In addition to transferring funds to other exchanges, some users are sending their funds directly to their on-chain wallets.”

KuCoin’s response

KuCoin has faced its legal battles head-on, with the exchange touting its compliance efforts.

CEO Johnny Lyu said the exchange’s legal battles are not unique and that the platform continues to operate optimally

Meanwhile, the exchange recently unveiled plans for a special $8.9 million airdrop of its KCS native token and Bitcoin to its users. Lyu explained that this airdrop was designed to compensate users who experienced withdrawal delays between March 26 and 28. Users who did not withdraw assets are expected to be airdropped more in reward for loyalty.

He added:

“I understand the importance of user trust and satisfaction. To express our gratitude for your loyalty and patience during the withdrawal congestion, we’re launching this airdrop plan as promised.”

[Editor’s Note: As with all airdrops, please ensure not to engage in any activity unlinked to official channels related to airdrops. Airdrops are one of the biggest attack vectors in crypto, and strict due diligence is essential.]

The post KuCoin’s assets and market share slide amid legal woes and user withdrawals appeared first on CryptoSlate.

Post a Comment