Quick Take

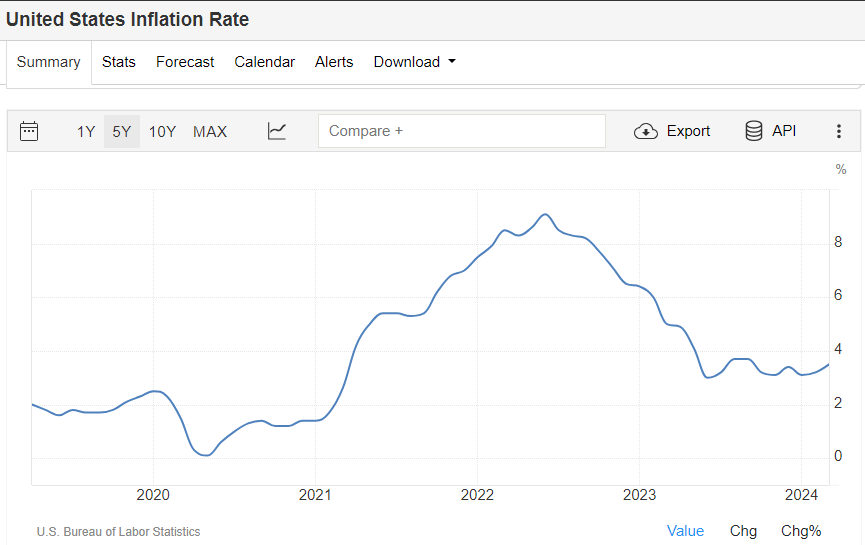

The latest US inflation data has surprised analysts, with headline inflation year-over-year (YoY) coming in at 3.5% — 0.1% above forecasts.

The development is significant considering the Federal Reserve’s most aggressive hiking cycle in decades, according to Statista, which aimed to tame the rampant inflation that the central bank initially claimed was transitory.

Despite headline inflation bottoming out at 3% in June 2023, it has since risen to 3.5% over nine months later, with Fed funds currently hovering between 5.25% to 5.5%.

Core inflation has maintained stability, hovering just below 4% since September 2023, as reported by Trading Economics. Consequently, Bitcoin is still treated as a risk-on asset at the moment and as a derivative of the Nasdaq-100 Index (QQQ) based on its drop below $68,000 on the CPI news.

However, there have been instances where Bitcoin behaved like a risk-off asset, such as during the Cyprus crisis.

The inflation data has also impacted bond yields, with the front end of the treasury curve (3 and 6 months) indicating no rate cuts until Q3 at the earliest.

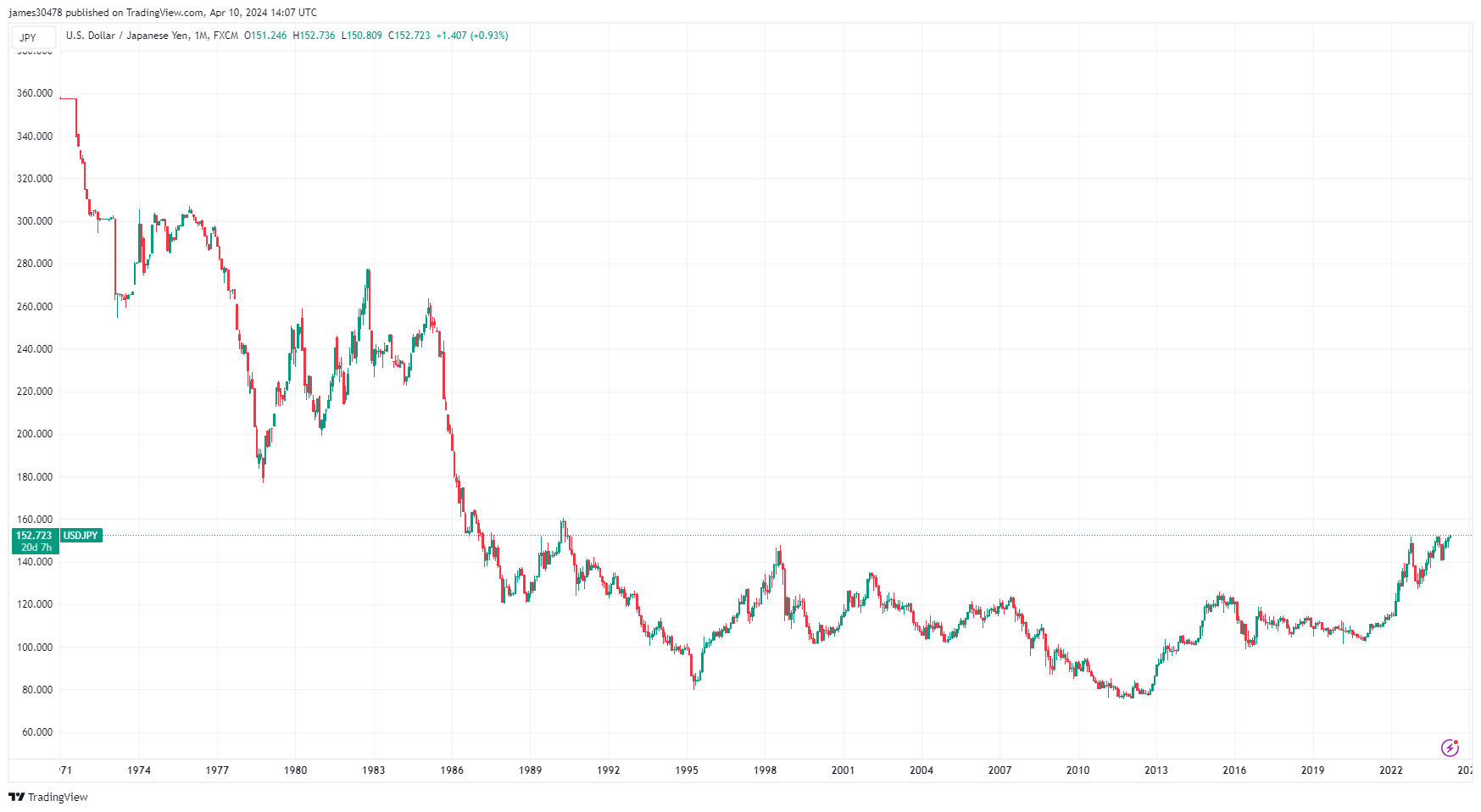

The DXY index moved higher above 105, and the USDJPY broke 152, a level not seen since 1990. This may prompt the Bank of Japan to increase interest rates to defend the weakened currency and its implications for the yen carry trade.

The post Bitcoin’s dual nature: shifting between risk-on and risk-off amid market turbulence appeared first on CryptoSlate.

إرسال تعليق