Quick Take

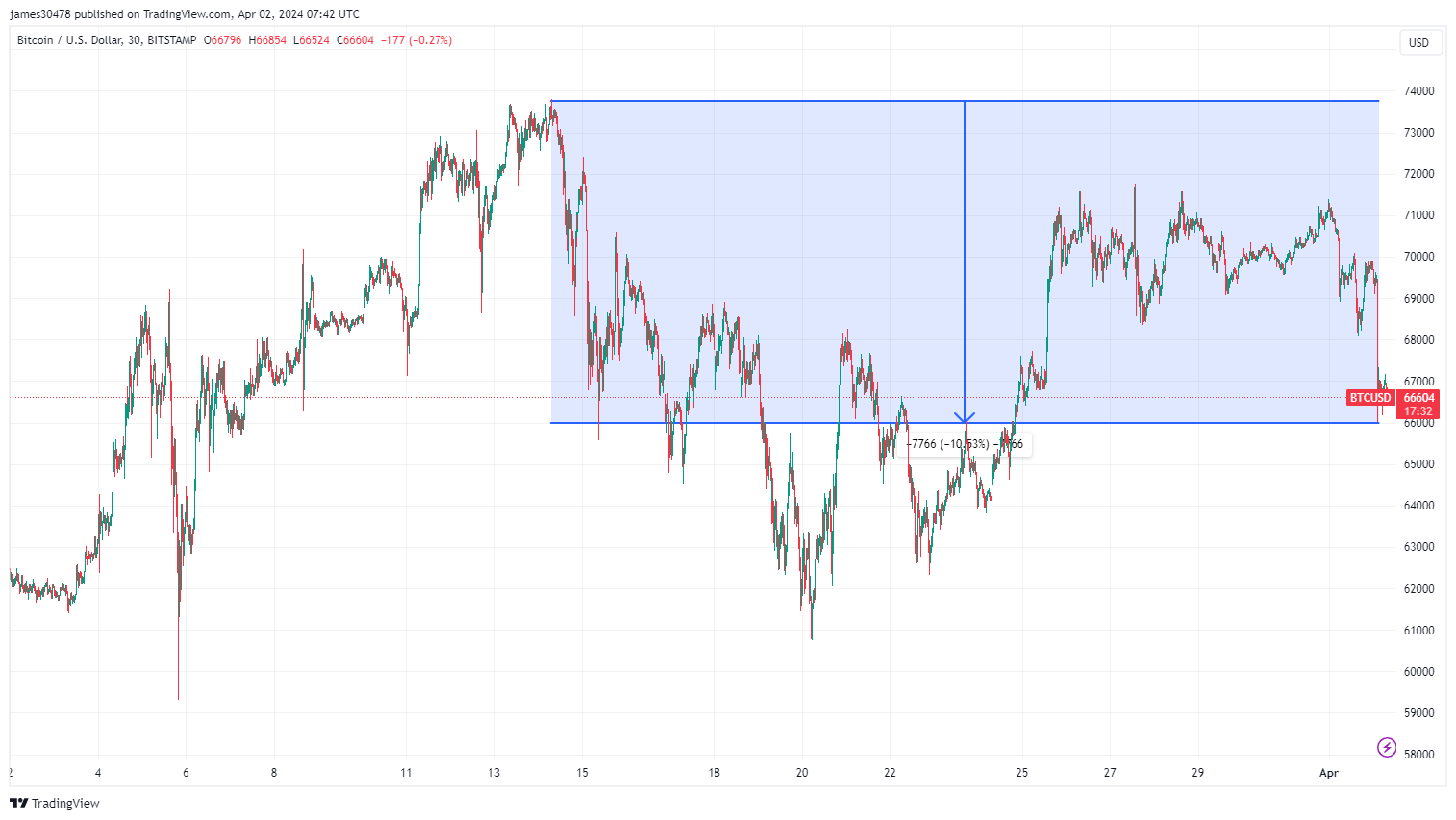

Bitcoin’s price took a tumble on April 2, briefly dipping just to $66,000 before recovering slightly to around $66,500 as of press time. This drop from the digital assets’s all-time high of approximately $73,500 on March 14 represents roughly a 10% decline.

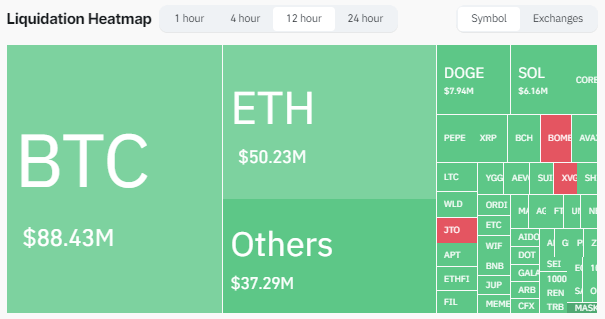

Coinglass data shows that the plunge triggered a flurry of liquidations across the digital asset ecosystem, with over $240 million worth of positions being closed out in the past 12 hours. A staggering $190 million of long positions were liquidated, significantly outweighing the roughly $50 million in short liquidations. Almost $400 million has been liquidated across all assets in the last 24 hours.

Coinglass data reports that Bitcoin accounted for the lion’s share of the bloodbath, with $88.43 million in total liquidations. A noteworthy $63 million consisted of long positions being closed out. This marks Bitcoin’s largest long liquidation event since March 19, underscoring the volatility that continues to roil the leading digital asset.

The post Bitcoin tumbles to $66,000 triggering over $240 million in market liquidations appeared first on CryptoSlate.

Post a Comment