Launched on the day of the Bitcoin halving, Runes are a form of data embedded directly into Bitcoin transactions. Unlike simple financial transfers, Runes encapsulate additional information within these transactions.

Bitcoin Runes operate by utilizing a method known as “transaction augmentation,” which allows users to embed arbitrary data into transaction outputs. Runes can store a variety of data types, from simple messages to more complex contract-like scripts.

This mechanism is distinctly different from other Bitcoin-based innovations such as Ordinals and BRC-20 tokens. Ordinals inscribe data into individual satoshis, turning each into a discrete and uniquely identifiable unit of data. It makes Ordinals ideal for representing digital artifacts like images or texts on the Bitcoin blockchain.

On the other hand, BRC-20 tokens are a token standard similar to Ethereum’s ERC-20, which is designed for issuing and managing tokens on Bitcoin’s sidechains — specifically the RSK Smart Contract Network.

The Runes protocol operates using a system known as Unspent Transaction Outputs (UTXOs). A UTXO represents a specific amount of Bitcoin that hasn’t been spent and can be used to fund new transactions. Runes are assigned to a UTXO via an OP_RETURN function, which allows data to be embedded in transactions without cluttering the network.

In a transaction, a Rune is linked to a UTXO through an OP_RETURN output that specifies the output location, a unique numerical ID for the Rune, and the amount of Rune being transacted. This setup also handles Rune characteristics such as divisibility and other metadata, all encoded within the same transaction. The transfer of Runes between parties uses Bitcoin’s secure framework to detail which Runes are moving from one UTXO to another.

The strategic launch of Runes on the day of the halving leveraged the attention the event got from the broader market. This timing was chosen to maximize visibility and impact, leveraging the increased attention during halving when miner rewards are reduced, and the future price of Bitcoin is hotly debated.

The immediate impact Runes had on the Bitcoin network was huge. Even though the market was expecting high fees and congestion around the halving, the impact Runes had seems to have been unexpected.

Although Runes were designed to minimize network clutter by using OP_RETURN outputs, which are provably unspendable and thus do not contribute directly to the growth of the UTXO set, they can still lead to network congestion due to their popularity and the volume of transactions they generate.

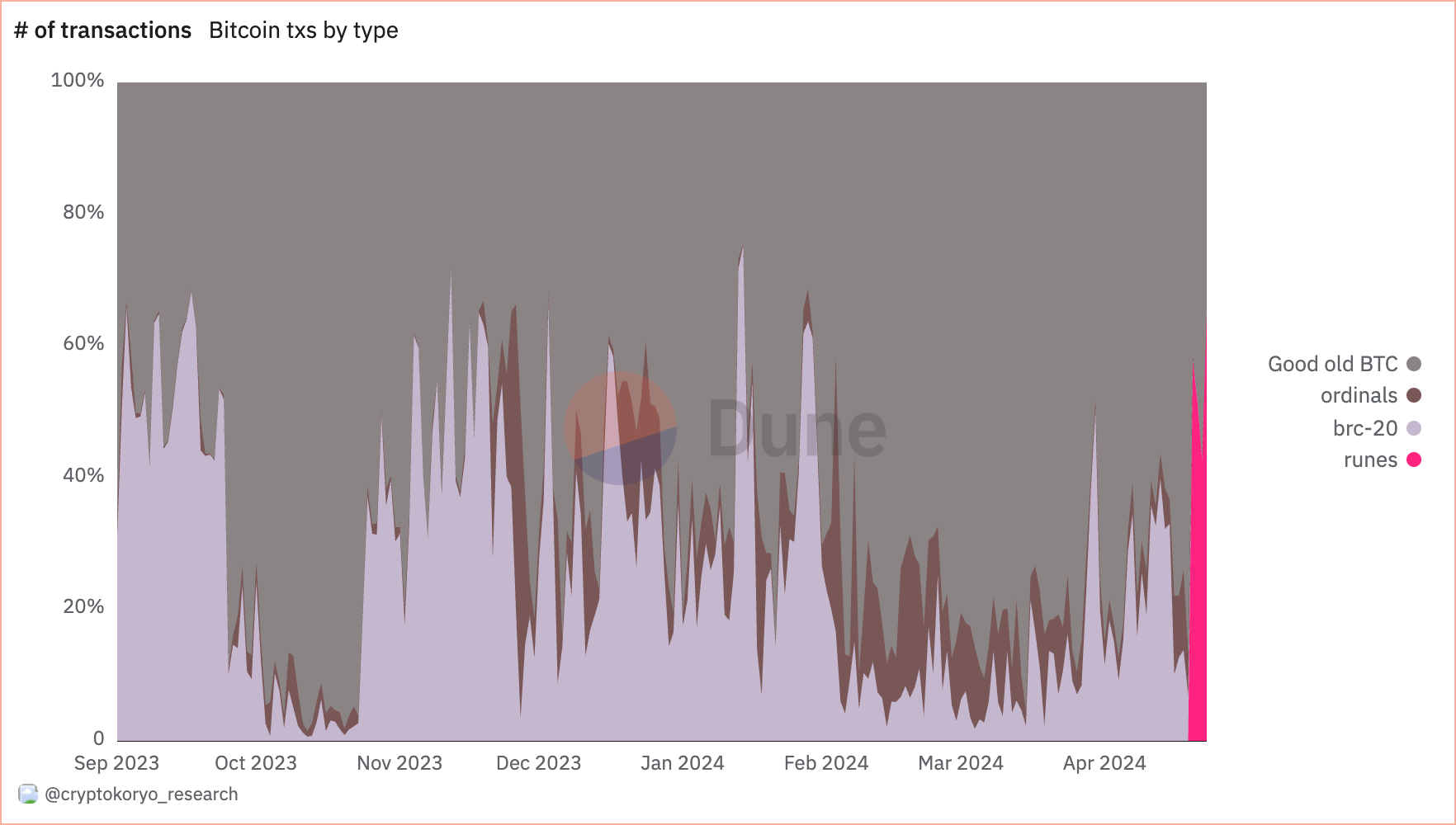

On April 19, the day before the halving, most transactions on the Bitcoin network were regular financial transactions, accounting for 86.7% of the total transaction share. Ordinals and BRC-20 transactions accounted for 6.5% and 6.9% of the total share, respectively.

On April 20, the day of the halving, Runes transactions accounted for 57.7% of all transactions on the Bitcoin network. Financial transactions accounted for a 41.5% share, while Ordinals and BRC-20 took up 0.5% and 0.2% of transactions, respectively.

Runes continued to dominate the network throughout the weekend, accounting for 51.6% of the total transactions on April 21. The dominance slightly decreased by April 22, dropping to 42.5%, with Bitcoin financial transactions accounting for 56.5% of the total transactions processed that day.

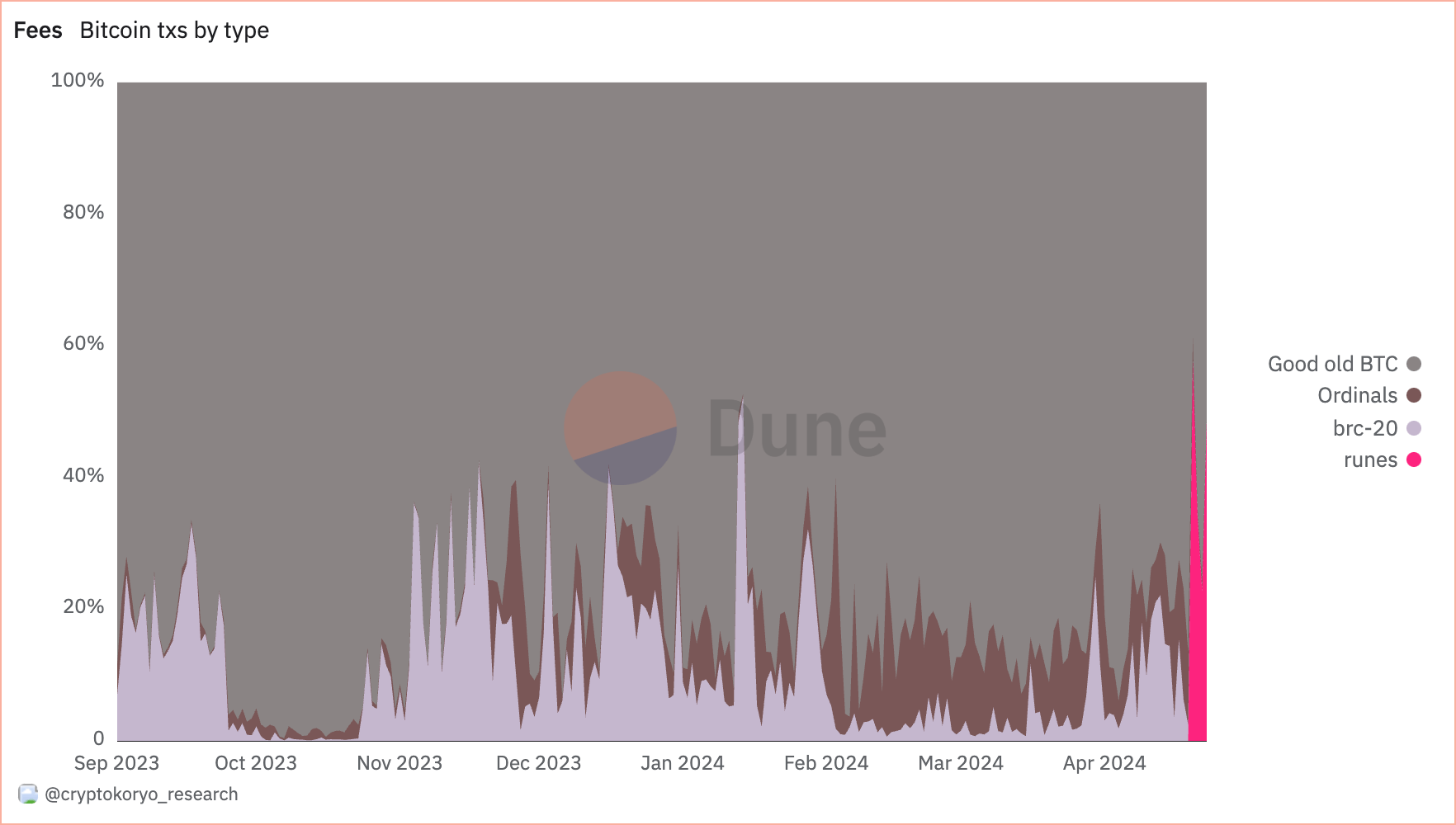

The financial implications of Runes were equally significant, as evidenced by the allocation of transaction fees. On April 20, Runes accounted for 57.7% of the transactions paid on the Bitcoin network.

The share of fees from financial transactions dropped from 86.6% on April 19 to 38.7% on April 20. However, the share of fees from Runes decreased in the days since the halving, as they accounted for 34.5% of the fees on April 21 and 22.8% on April 22.

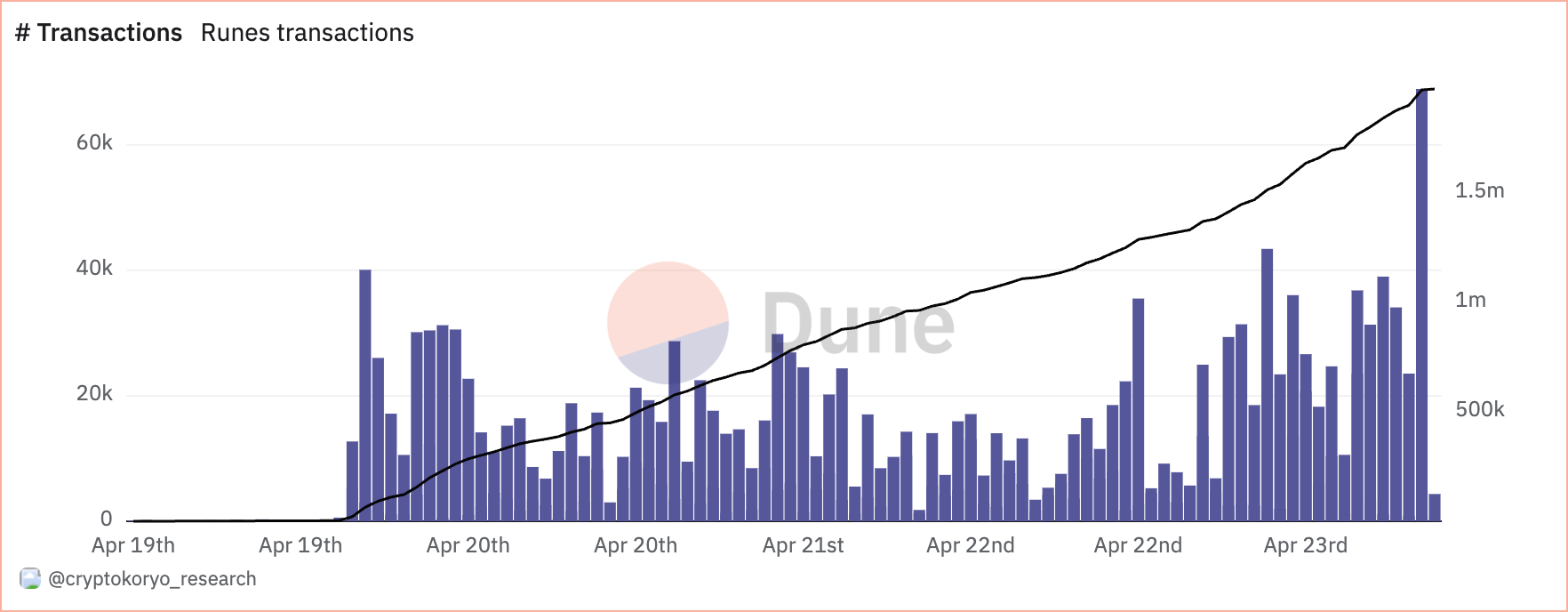

As of April 23, there have been 1.973 million Runes transactions.

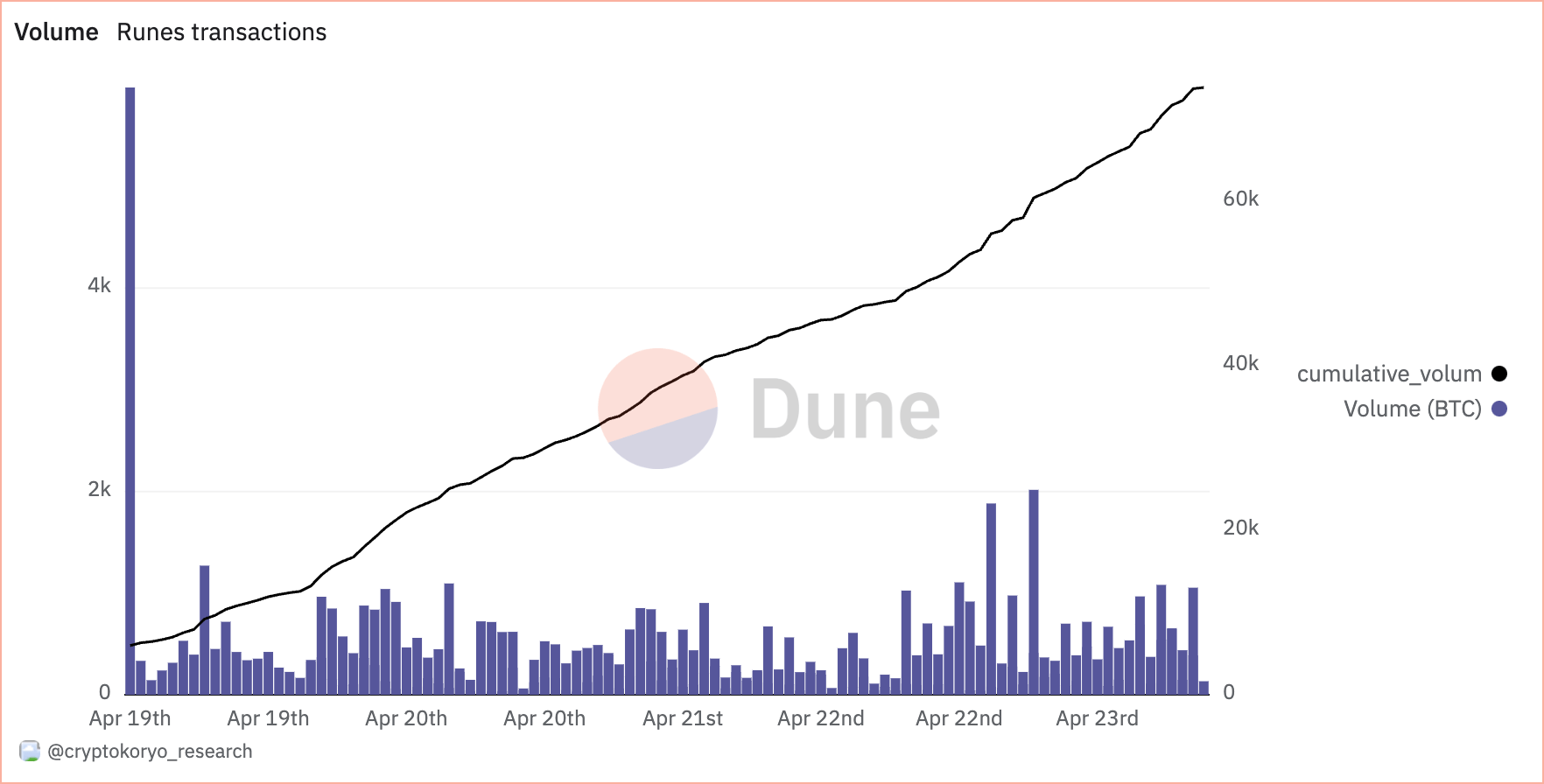

They generated 1,484 BTC in fees and reached a cumulative volume of 73,765 BTC.

Despite their bombastic launch, the immediate effects of Runes on the network have somewhat moderated in the days following the halving. The decline in the share of Runes in transactions and fees suggests that while the initial excitement was high, the ongoing integration of Runes into regular transaction patterns might see a more gradual growth.

The full consequences Runes will have on the Bitcoin network are yet to be understood. A significant part of the market has been celebrating the introduction of a new form of interaction with the Bitcoin blockchain. While some are focused on the speculative opportunities standards like Runes and Ordinals enable, others seem excited about the innovation and users this could bring to the Bitcoin ecosystem.

However, an even larger part of the market has been warning about the increased load on the network caused by Runes, which could lead to higher fees and slower transaction times. The main issue critics seem to have is the dilution of Bitcoin’s purity. An expensive, congested network affects not only Bitcoin’s utility as a means of payment but also as a store of value.

Nonetheless, there seems to be a chance the network adjusts to the existence of Runes and absorbs the pressure they create. A relatively similar discourse surrounded Ordinals upon their launch, and almost a year and a half later, the data shows their impact is minimal.

While we might see more volatility in terms of fees in the coming weeks and months, it will take longer to see whether Runes become a foundational component of Bitcoin transactions or just a niche market within a larger ecosystem.

The post Bitcoin Runes made up 57.7% of transactions on halving day appeared first on CryptoSlate.

Post a Comment