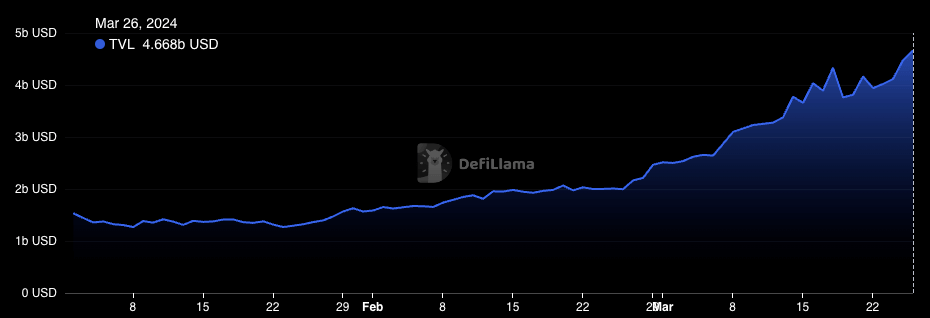

Solana‘s total value locked (TVL) currently stands at $4.666 billion, with a bridged TVL reaching just over $21 billion as of press time. This figure is distributed across dozens of protocols, each contributing to the burgeoning ecosystem in a unique way.

The distribution of value across protocols is an indicator of user preferences, emerging trends, and the fast-growing and evolving needs of the Solana community. Analyzing this distribution is crucial in understanding the direction the network is heading and its users’ priorities:

- Marinade ($1.958b) is Solana’s leading liquid staking solution, allowing users to stake SOL and receive stSOL, enhancing liquidity and flexibility.

- Jito ($1.763b) accelerates Solana’s blockchain performance, focusing on scalability and efficient transaction processing.

- Kamino ($1.397b), a liquidity management platform, optimizes yield farming strategies, enhancing the DeFi experience.

- Marginfi ($827.77m) integrates trading and lending into a single platform, offering diverse financial products.

- Raydium ($611.32m) is an automated market maker (AMM) and liquidity provider built on the Solana blockchain for the Serum decentralized exchange (DEX).

- BlazeStake ($467.54m) focuses on staking solutions, offering users a way to earn rewards by securing the network.

- Jupiter ($383.4m) offers perpetual swap contracts, enabling leveraged trades without expiry dates.

- Drift ($336.49m) is a decentralized platform offering derivatives and leverage trading on Solana.

- Solend ($283.35m) is a decentralized protocol for lending and borrowing, showcasing the growth of lending markets on Solana.

- Orca ($270.2m) is a user-friendly DEX that emphasizes simplicity and accessibility in trading.

A closer look at the TVL distribution using data from DeFiLllama shows a clear inclination towards protocols offering liquidity and lending services, with Marinade, Jito, and Kamino leading the pack. This indicates a robust demand for liquidity solutions and yield-generating opportunities among Solana’s users. It also reflects a growing sophistication in the DeFi space, where users seek more than just token swaps — they’re actively looking for platforms that can provide high leverage and a greater potential to earn.

As the largest protocol in terms of TVL, Marinade reflects this increased interest in staking solutions, particularly those that provide high liquidity. By offering stSOL in return for staking SOL, Marinade addresses the liquidity dilemma often faced by stakers, allowing them to participate in DeFi activities without locking their assets.

Jito and Kamino reflect a preference for scalability and optimized yield farming. Jito’s focus on increasing Solana’s throughput capabilities shows users are looking for a competitive edge in transaction efficiency. On the other hand, Kamino caters to yield farmers and their complex farming strategies, showing the community is gravitating toward more complex financial instruments than just swaps.

Comparing the popularity of lending protocols against decentralized exchanges (DEXs) shows lending platforms like Solend have amassed significant TVL. While it’s notably lower than the value locked in staking solutions, it shows a growing preference for lending. While Solana is still in its infancy, even in DeFi terms, this trend indicates a maturing space with a mature subset of users looking into leveraging their assets for loans or earning interest — a stark contrast to the earlier days of DeFi, where DEXs dominated the landscape.

The distribution of TVL across Solana’s protocols sheds light on a network that is becoming increasingly diversified. While memecoins have become a significant trend on Solana, their impact on TVL and its distribution seems minimal. As these tokens have a very short lifespan and are predominantly traded on DEXs, their transient nature means they contribute little to the stability or growth of Solana’s TVL.

The post Solana’s DeFi landscape matures with significant growth in liquidity and lending sectors appeared first on CryptoSlate.

إرسال تعليق