Quick Take

The digital asset market is witnessing an accelerated phase of Bitcoin (BTC) accumulation across two distinct cohorts: Shrimps and Sharks.

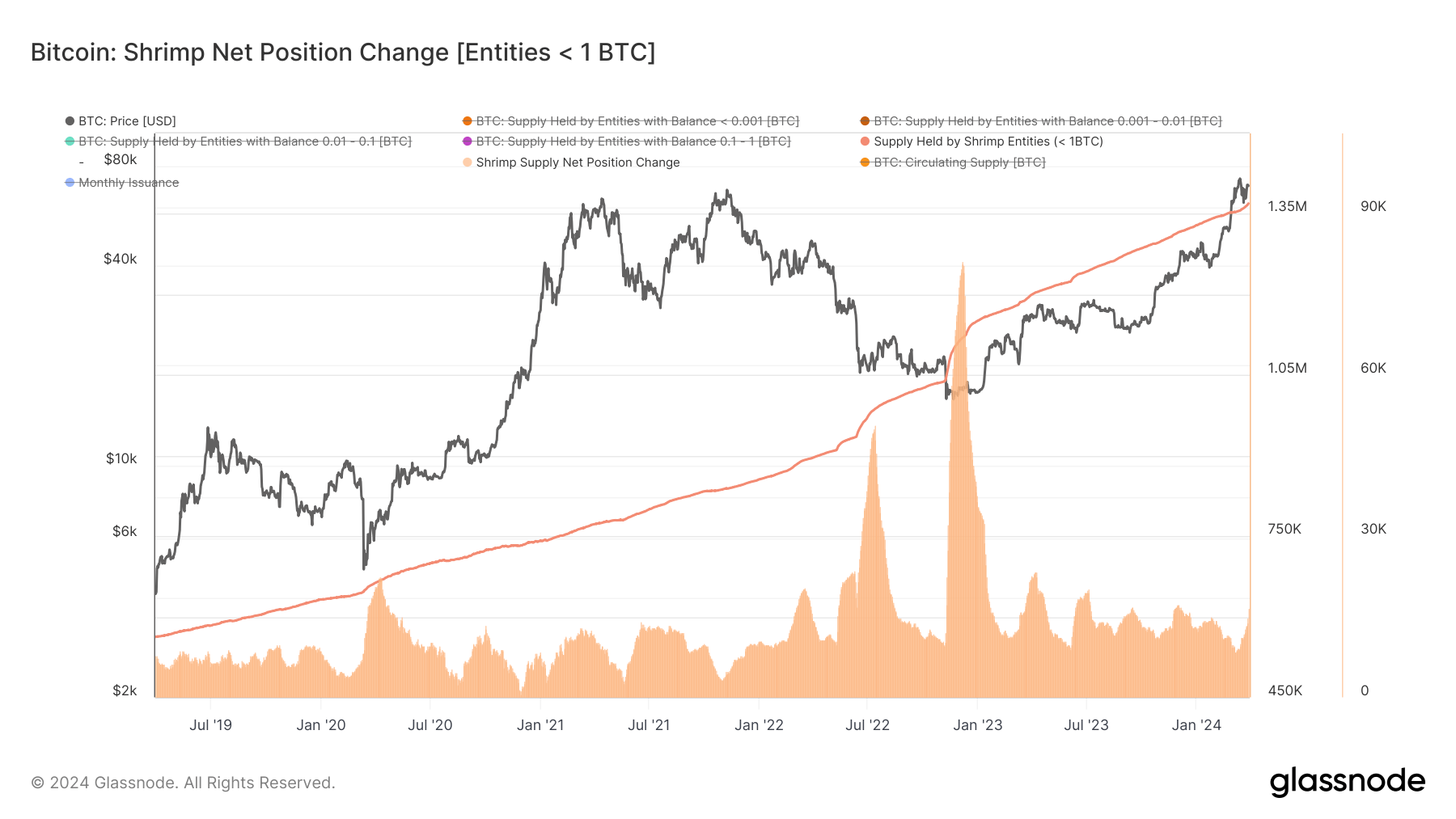

The “Shrimp cohort” refers to retail investors holding less than one Bitcoin who have traditionally increased their holdings steadily.

Currently, this group is exhibiting its most assertive accumulation since November 2023, expanding its collective BTC holdings by 16,769 BTC over the last 30 days — totaling approximately 1.37 million BTC, according to Glassnode data.

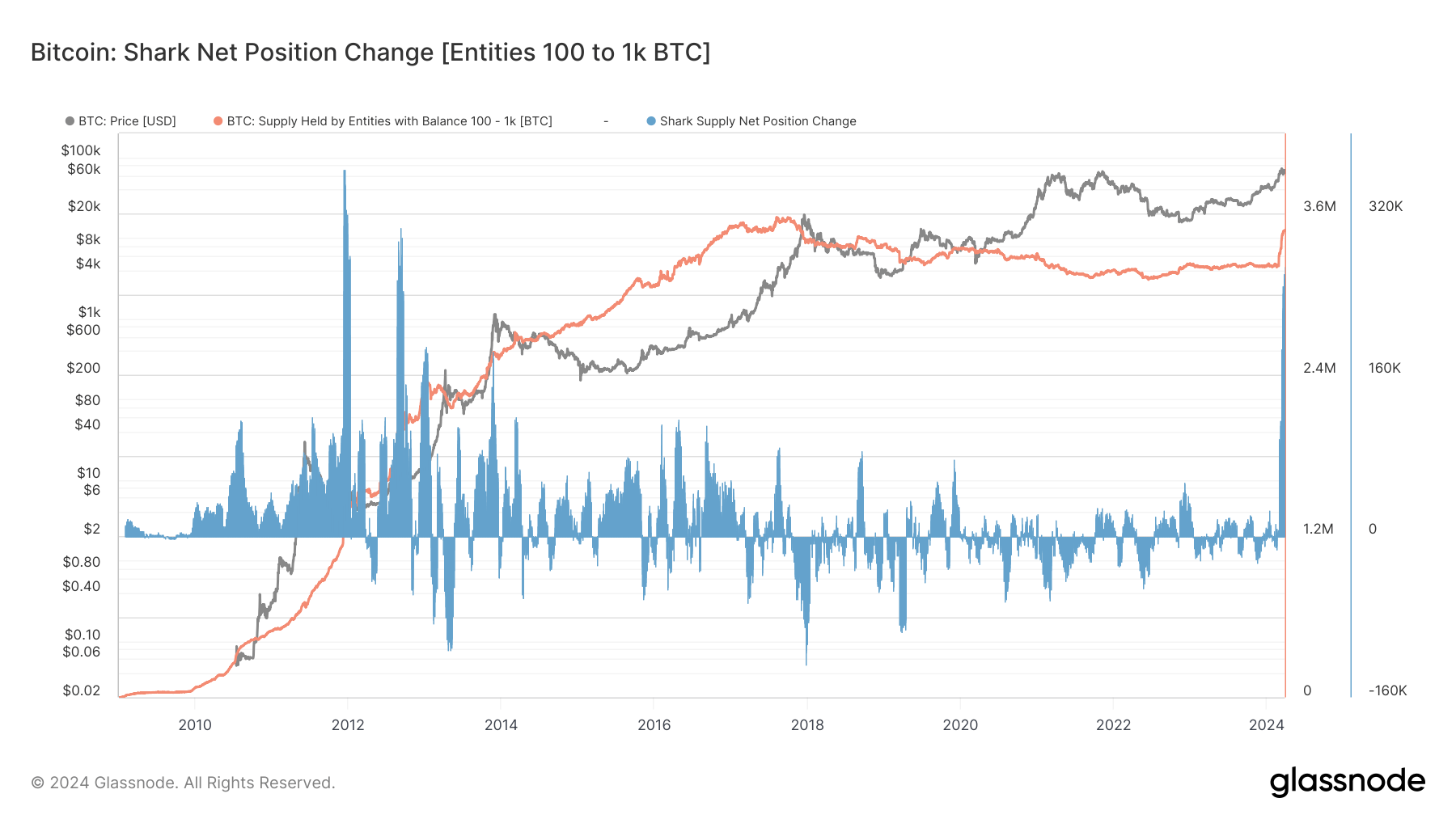

On the other hand, the “Shark” cohort comprises higher-net-worth individuals, trading desks, and institutional entities holding between 100 and 1,000 BTC.

This group has shown remarkable accumulation, with their total balance witnessing a 30-day net position change of 268,441 BTC, the largest increase since 2012. Collectively, the Shark cohort now holds 3.5 million Bitcoin, according to Glassnode data.

Notably, CryptoSlate reported that all cohorts on aggregate are currently accumulating more Bitcoin than the monthly issuance over the past 30 days, signaling a broad-based bullish sentiment in the market.

The post Bitcoin accumulation hits decade high among ‘Shark’ cohort appeared first on CryptoSlate.

Post a Comment