After a brief struggle to regain footing, Bitcoin finally broke through the $52,000 barrier on Feb. 14. While $50,000 was a critical psychological benchmark, trading above $52,000 indicates rising market confidence in Bitcoin and can mean the end of the bear market.

During periods of price volatility, especially significant upward movements, it’s important to analyze the availability of Bitcoin’s supply. Knowing how much of Bitcoin’s supply is theoretically available for trading can show us the amount of buying or selling pressure the market could absorb. An increase in supply ready to be traded can cause the price to drop if there’s no demand to meet it. Conversely, a decrease in the supply of Bitcoin that can be quickly bought can cause a supply crunch that leads to an increase in price.

Supply availability can’t be seen through a single metric. The supply of Bitcoin sitting in exchange wallets is usually taken as the best proxy, but it offers little depth. CryptoSlate analyzed several other on-chain metrics, including UTXOs and accumulation addresses, to better understand whether the tradeable supply is tightening.

There are, of course, many other metrics that can further and better show the state of the market. For example, the differences in long-term and short-term holder supplies can show if there’s an increase in the tradeable (STH) and non-tradeable (LTH) supply, which could create a crunch. However, focusing on less widely used metrics like UTXOs can provide a fresh view of a heavily-analyzed topic.

Unspent Transaction Outputs (UTXOs) are essential in understanding the Bitcoin network. UTXOs represent the amount of BTC that remains unspent and stored in a wallet after a transaction, serving as a fundamental indicator of Bitcoin’s liquidity and movement within the market.

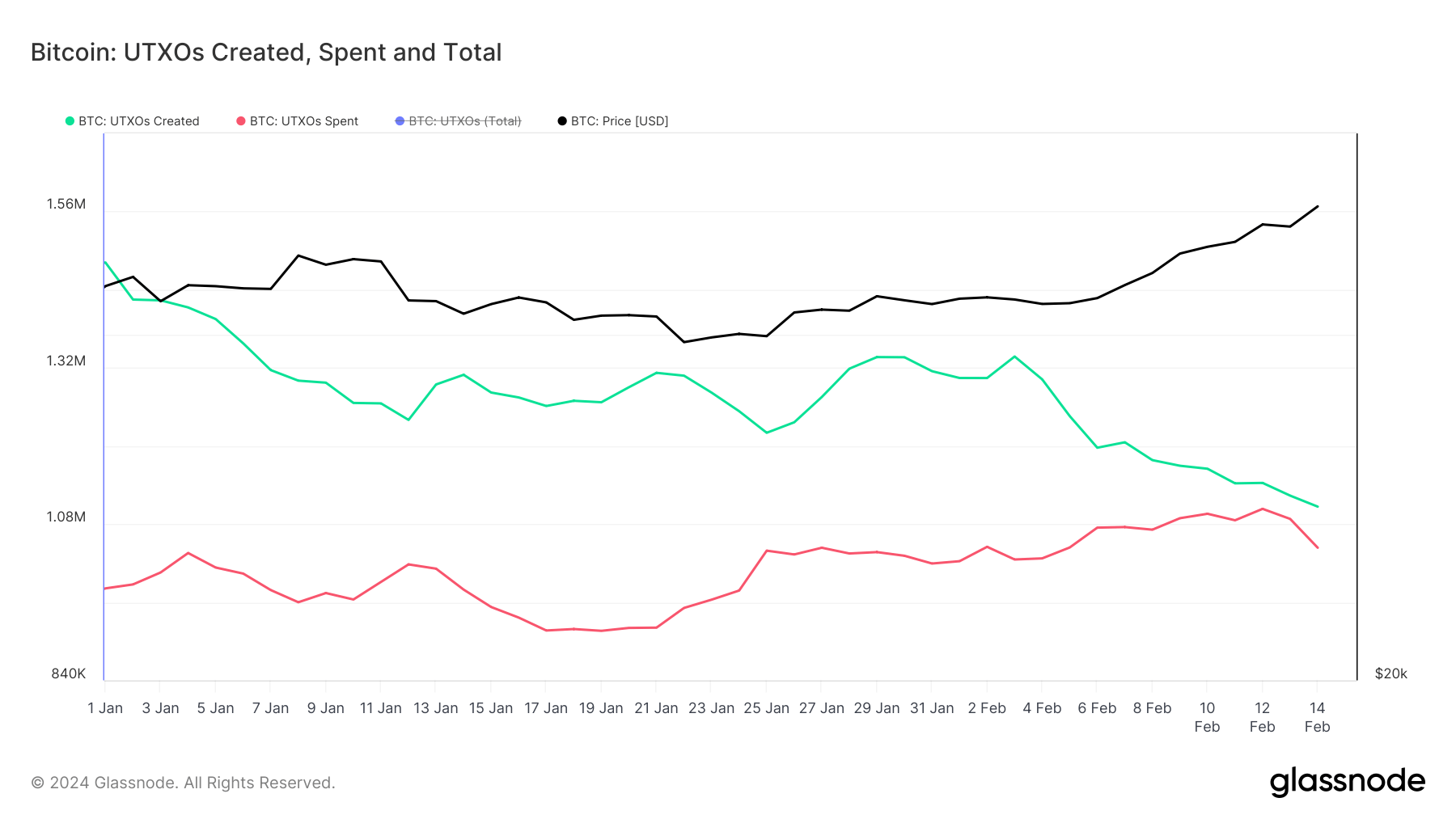

On Feb. 1, the number of created UTXOs stood at 1.304 million, which decreased to 1.106 million by Feb. 14. Concurrently, the number of spent UTXOs remained relatively stable. This drop suggests that there has been a decrease in the willingness to transfer BTC between addresses.

This trend can be seen as the first sign of a potential liquidity crunch, which could significantly impact Bitcoin’s price in the coming weeks.

The launch of spot Bitcoin ETFs in the US was one of the most significant milestones for Bitcoin when it comes to institutional adoption, introducing a regulated, mainstream investment vehicle for Bitcoin exposure. These ETFs, which have seen over $4.1 billion in flows since they began trading just over a month ago, use OTC desks to acquire BTC. This method of acquisition, previously analyzed by CryptoSlate, has a significant effect on supply availability.

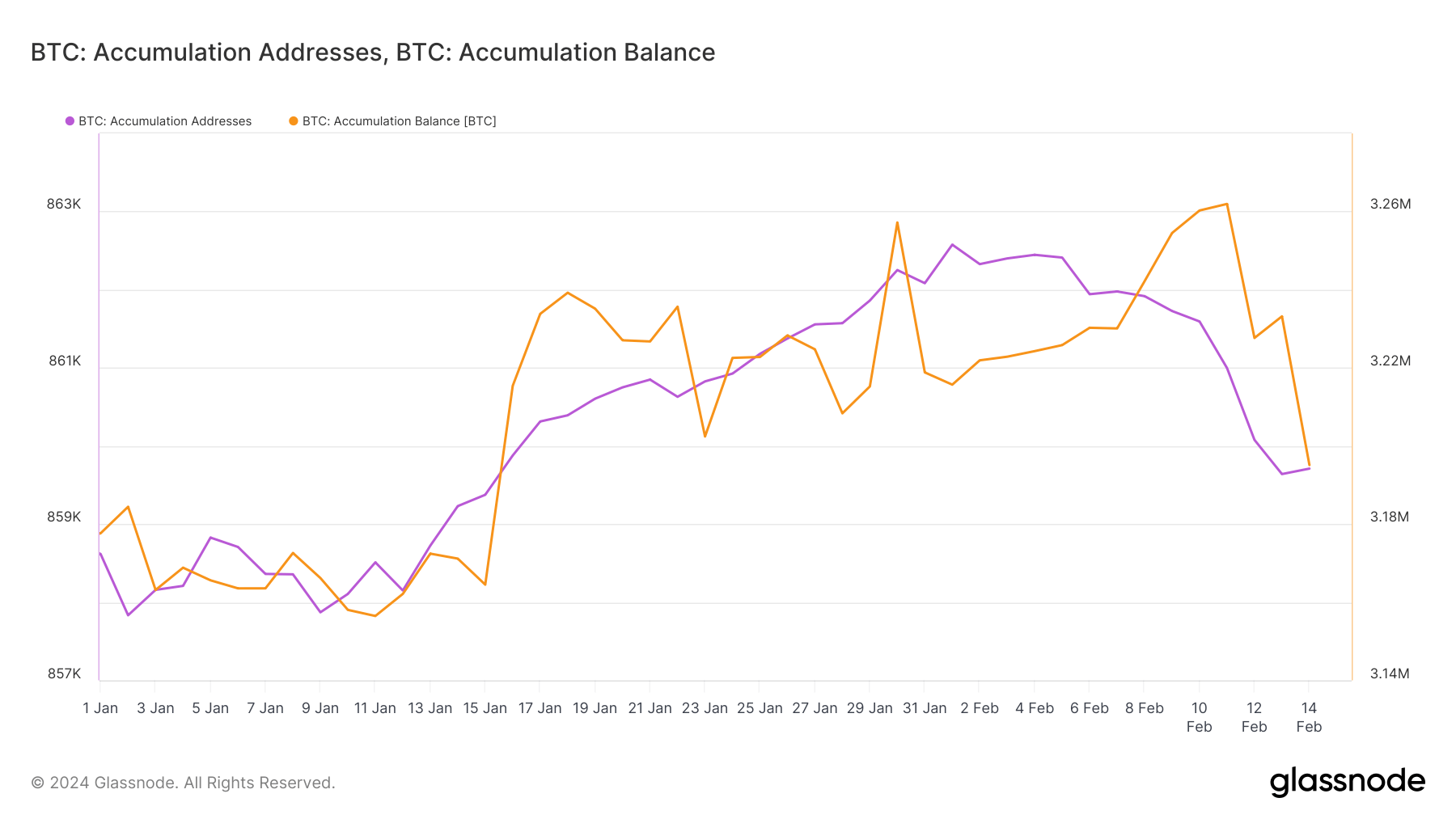

Namely, there has been a notable decrease in the amount of Bitcoin held in accumulation addresses, from 3.215 million BTC on Feb.1st to 3.195 million BTC by Feb. 14, and a minor reduction in the number of these addresses.

This decline can suggest a strategic mobilization of long-held BTC. With a consistent increase in long-term holder supply, this could be attributed to the rise in selling to OTC desks, which cater to the growing demand from ETFs.

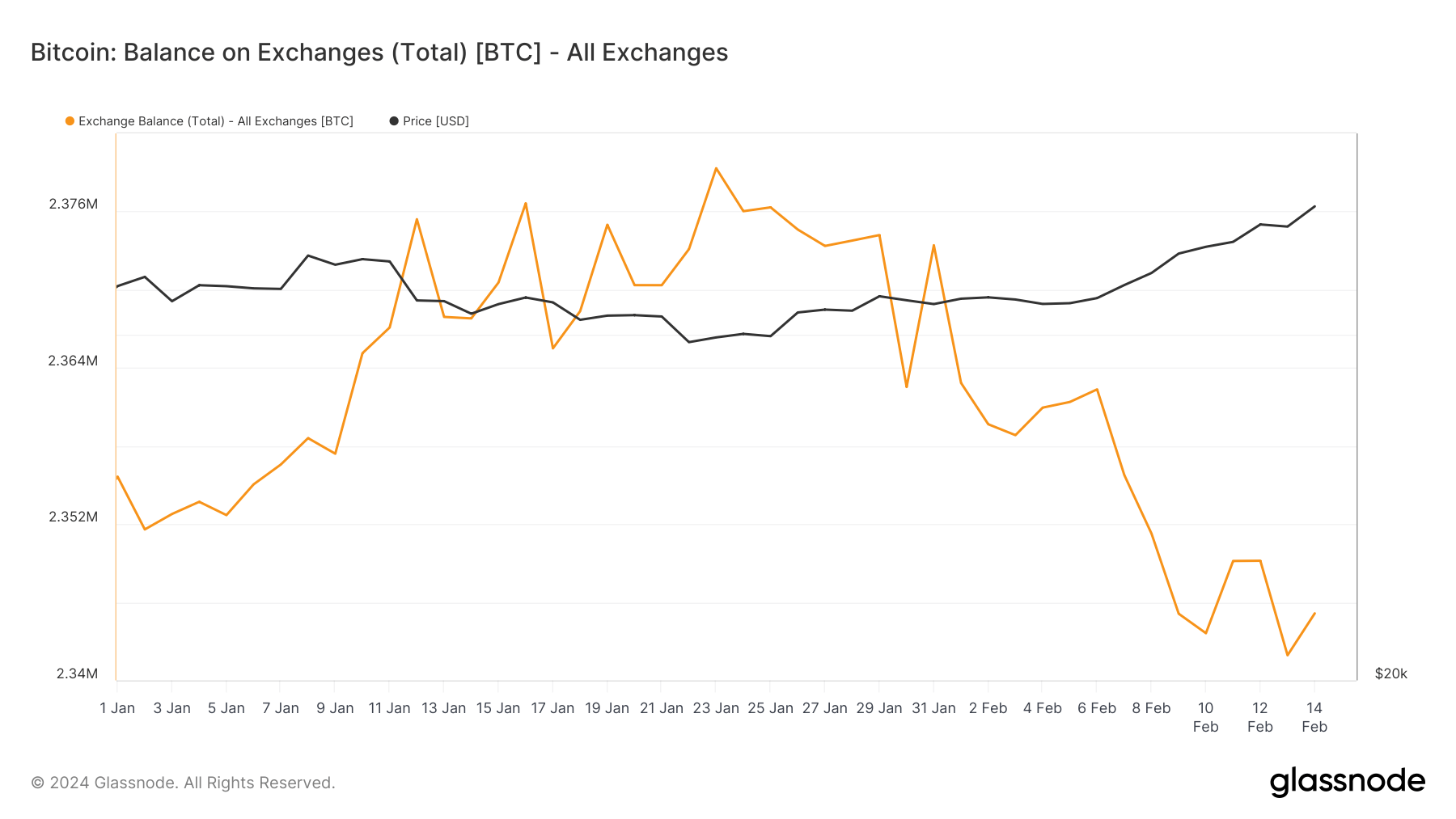

Furthermore, there has also been an observable decrease in the amount of Bitcoin held in exchange wallets, dropping from 2.363 million BTC on Feb. 1 to 2.345 million BTC on Feb. 14. While this is a continuation of a year-long trend, it shows that there’s a very tangible tightening of the supply available for trading.

The compounded factors of a drop in UTXO creation, a reduction in Bitcoin held in accumulation addresses, a decline in exchange balances, and substantial inflows into spot Bitcoin ETFs show a significant change in the market. This change can potentially cause an even further decrease in the supply available for trading against a backdrop of increasing demand, particularly from institutional investors through ETFs.

The post On-chain data shows Bitcoin supply is tightening appeared first on CryptoSlate.

Post a Comment