Bitcoin has broken through the $50,000 mark, trading at over $52,000 at press time, marking a significant milestone as it’s the first time it regained its losses from November 2022. With Bitcoin’s struggles to cross above $49,000 this week, it has been particularly eventful for the futures market, highlighting a keen interest from traders and investors alike in leveraging futures contracts to speculate on its future price movements.

Analyzing futures in times of volatility is extremely important as it sheds light on market sentiment, trader behavior, and potential price directions. Futures, agreements to buy or sell an asset at a future date at a predetermined price, are a tool for investors to hedge against price risks or speculate on price movements. Changes in the futures market, especially in times of significant price movements, can help show the collective expectations of market participants.

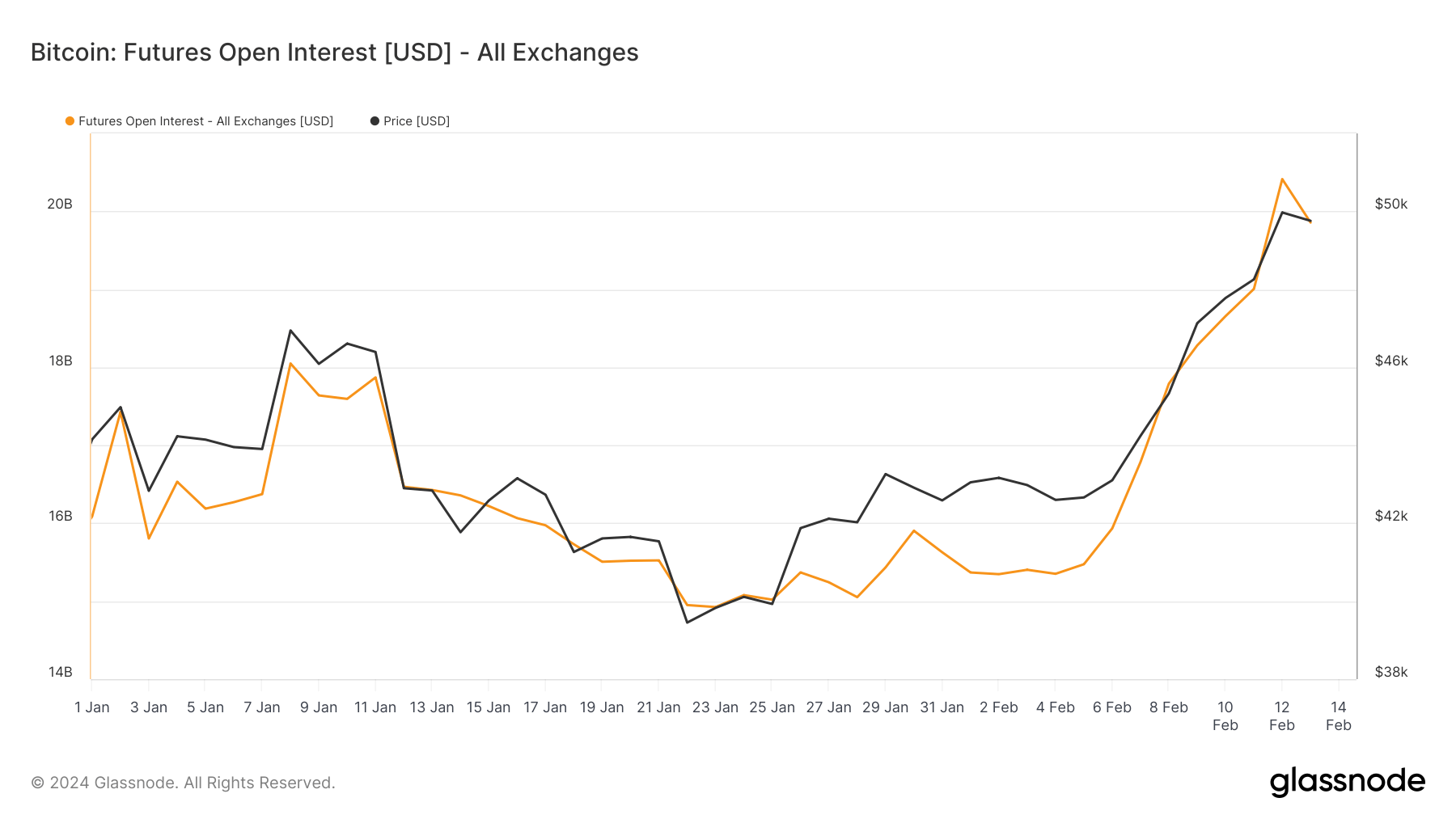

Bitcoin’s rise to $50,000 caused a notable increase in open interest for futures and perpetual futures contracts.

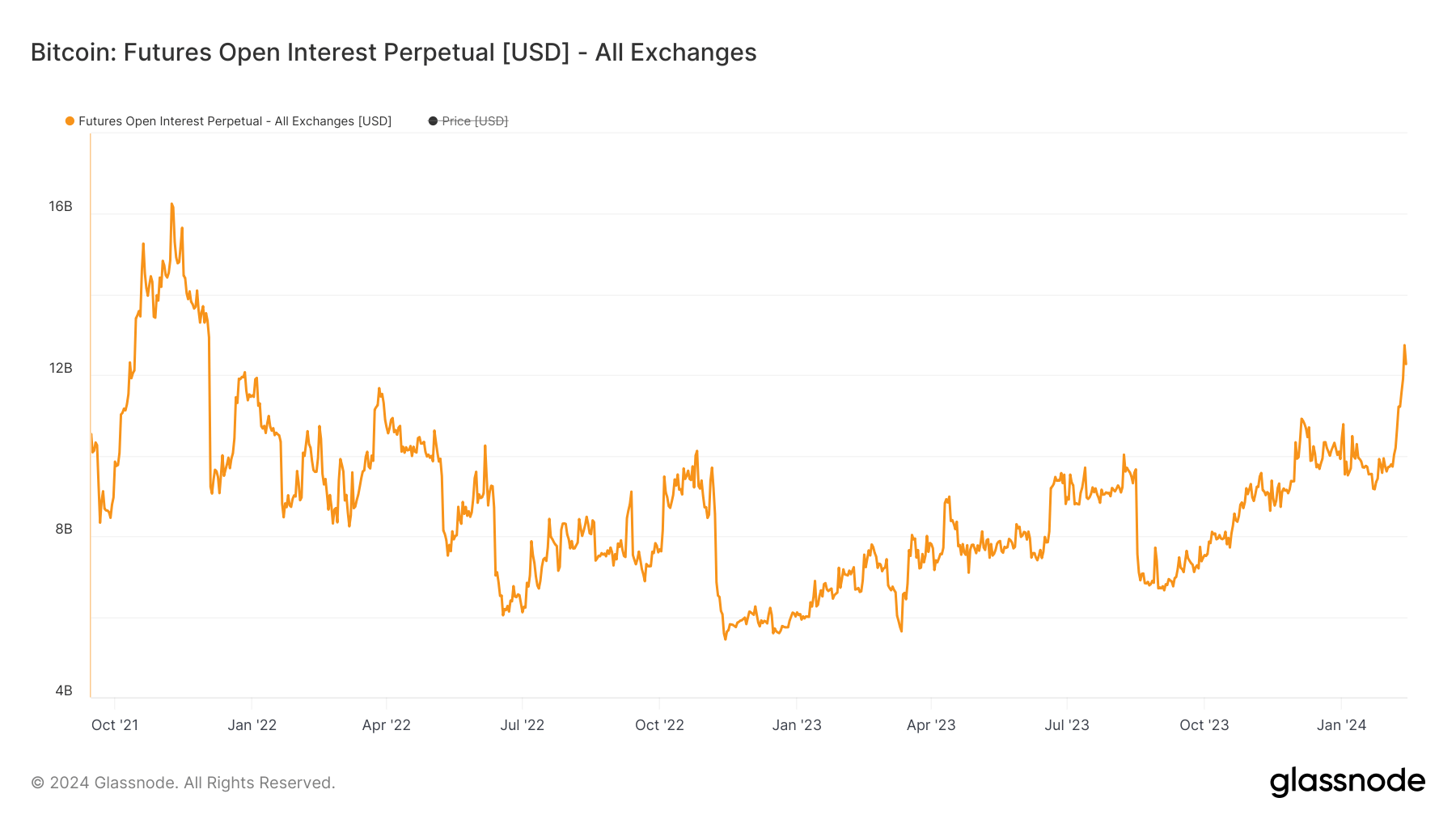

Perpetual futures open interest experienced a significant uptick this month, from $9.716 billion on Feb. 1 to $12.742 billion on Feb. 12 — the highest since December 2021. This rise shows speculative activity in Bitcoin is growing, given that perpetual futures—contracts without an expiration date—are commonly used for short-term trading strategies. The slight decrease on Feb.13 to $12.273 billion might suggest a period of minor consolidation, liquidation, and profit-taking following the price spike.

Bitcoin futures open interest reached a two-year high on Feb. 12 at $20.413 billion.

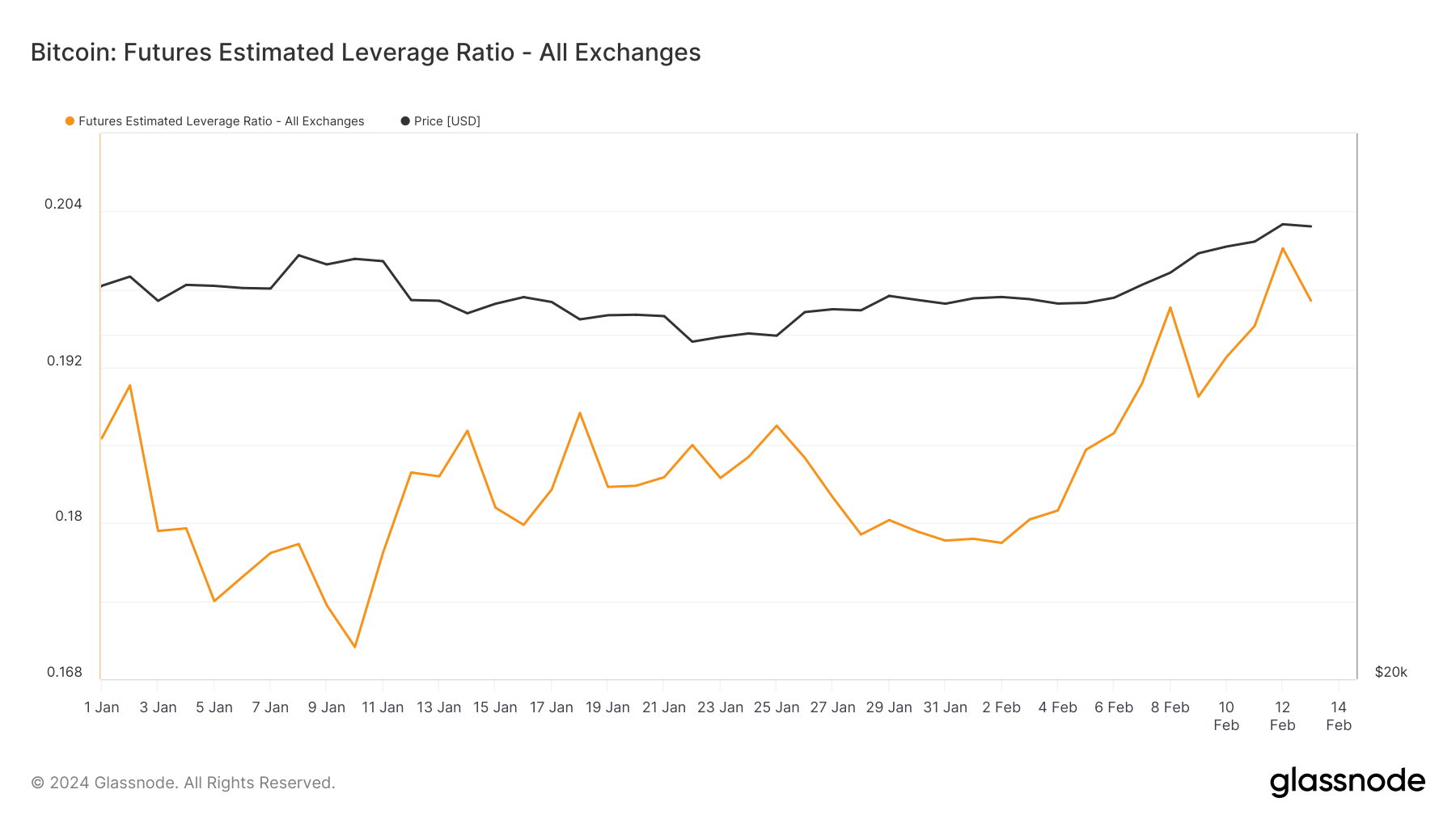

The estimated futures leverage ratio, which quantifies the average leverage used by investors in the futures market, increased from 0.178 on Feb. 1 to 0.201 on Feb. 12. This uptick shows an increase in risk-taking among traders, as leverage amplifies both potential gains and losses, contributing to greater market volatility.

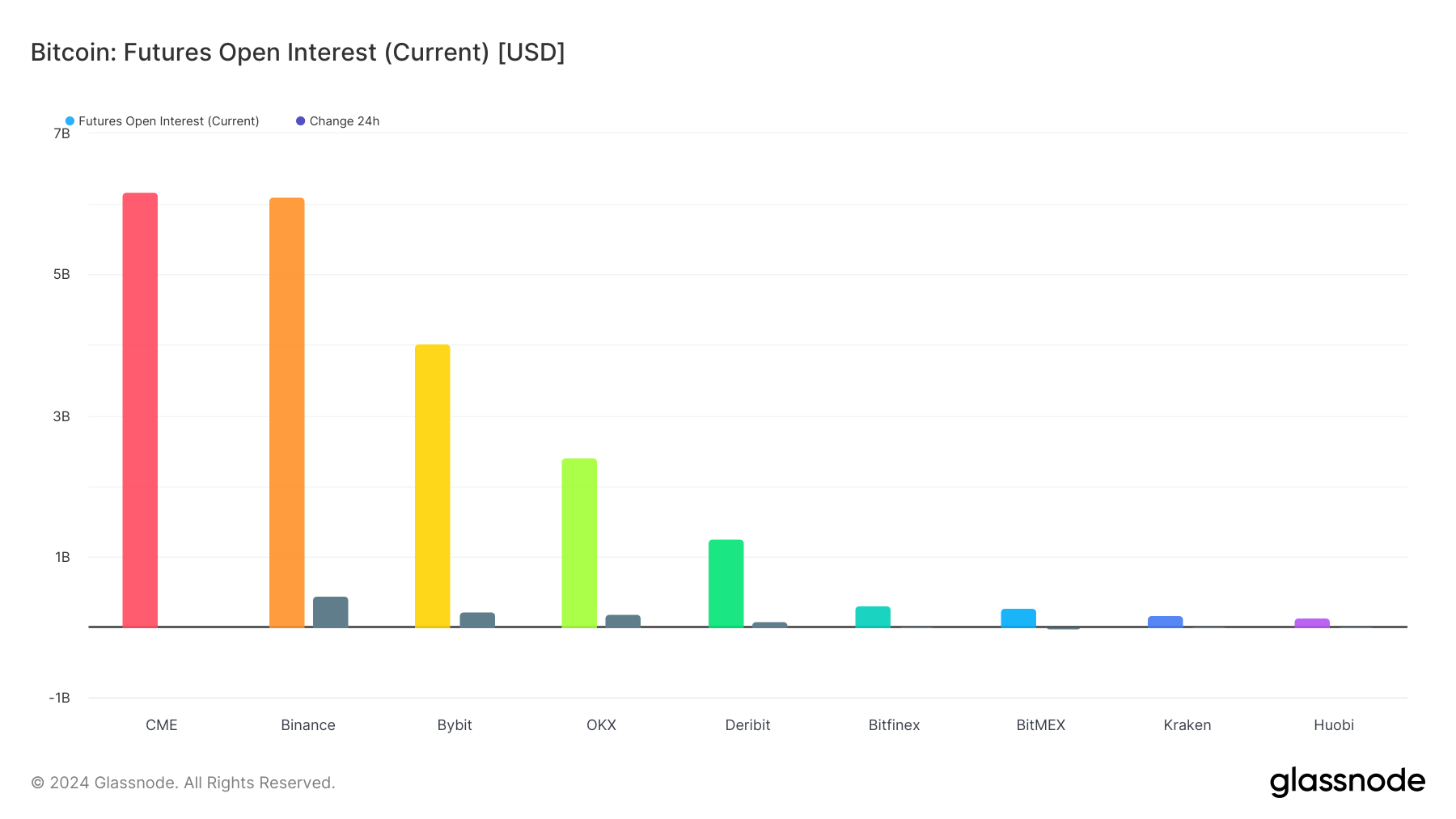

This increase in perpetual and fixed-date futures contracts shows a surge in trading activity and could create greater liquidity in the market. The distribution of futures open interest across exchanges, with CME and Binance leading on Feb.12, indicates almost equal participation from institutions and retail. This is particularly noteworthy for Binance, which has been vying to surpass CME as the leading derivatives exchange, marking a significant milestone for the exchange and the retail market.

Given these observations, the current trend suggests an active and engaged futures market characterized by bullish sentiment and increased risk-taking. This environment could foster continued price volatility, driven by speculative trading and leveraged positions.

The post Futures open interest hits two-year peak with Bitcoin above $50k appeared first on CryptoSlate.

Post a Comment