Quick Take

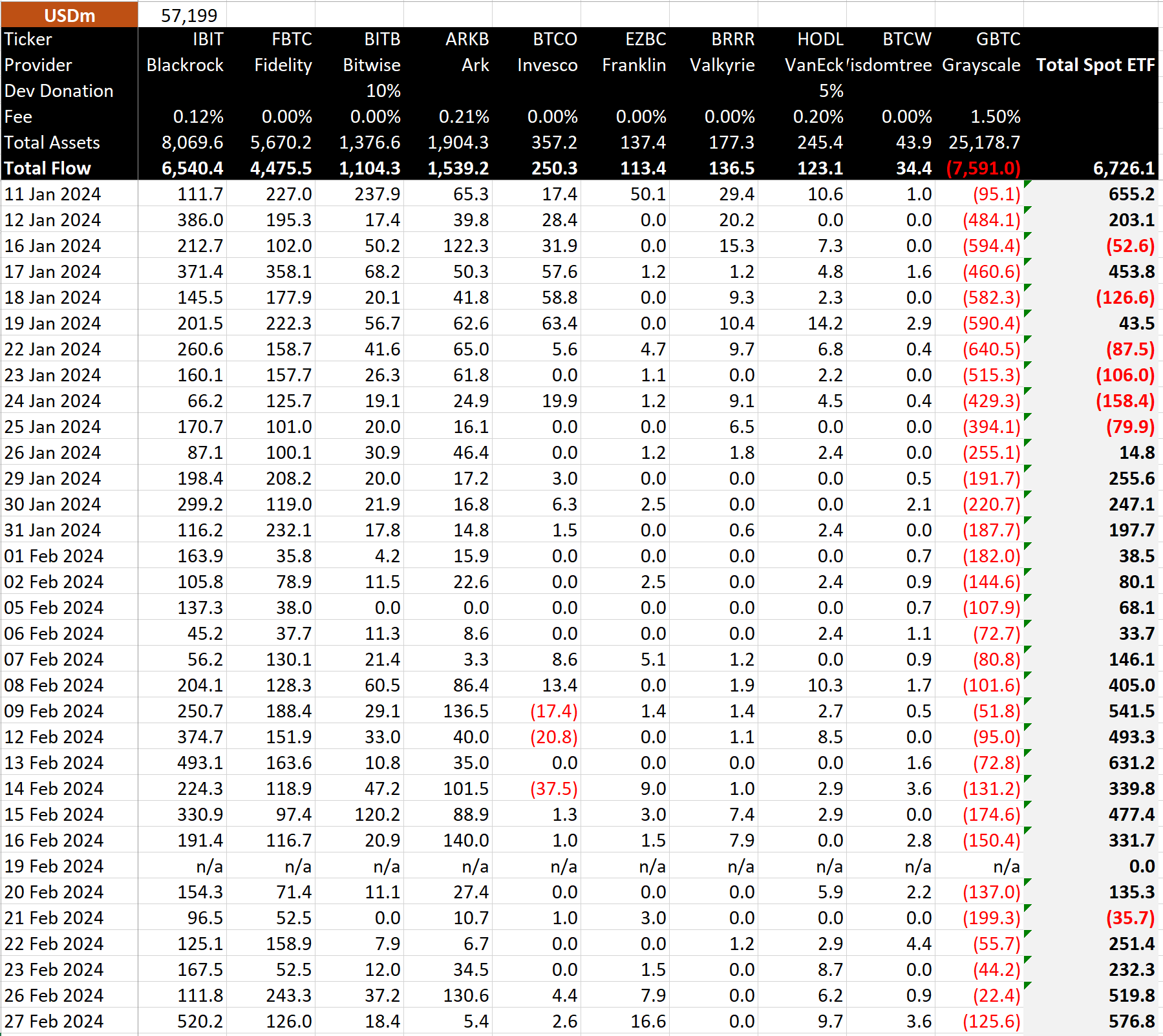

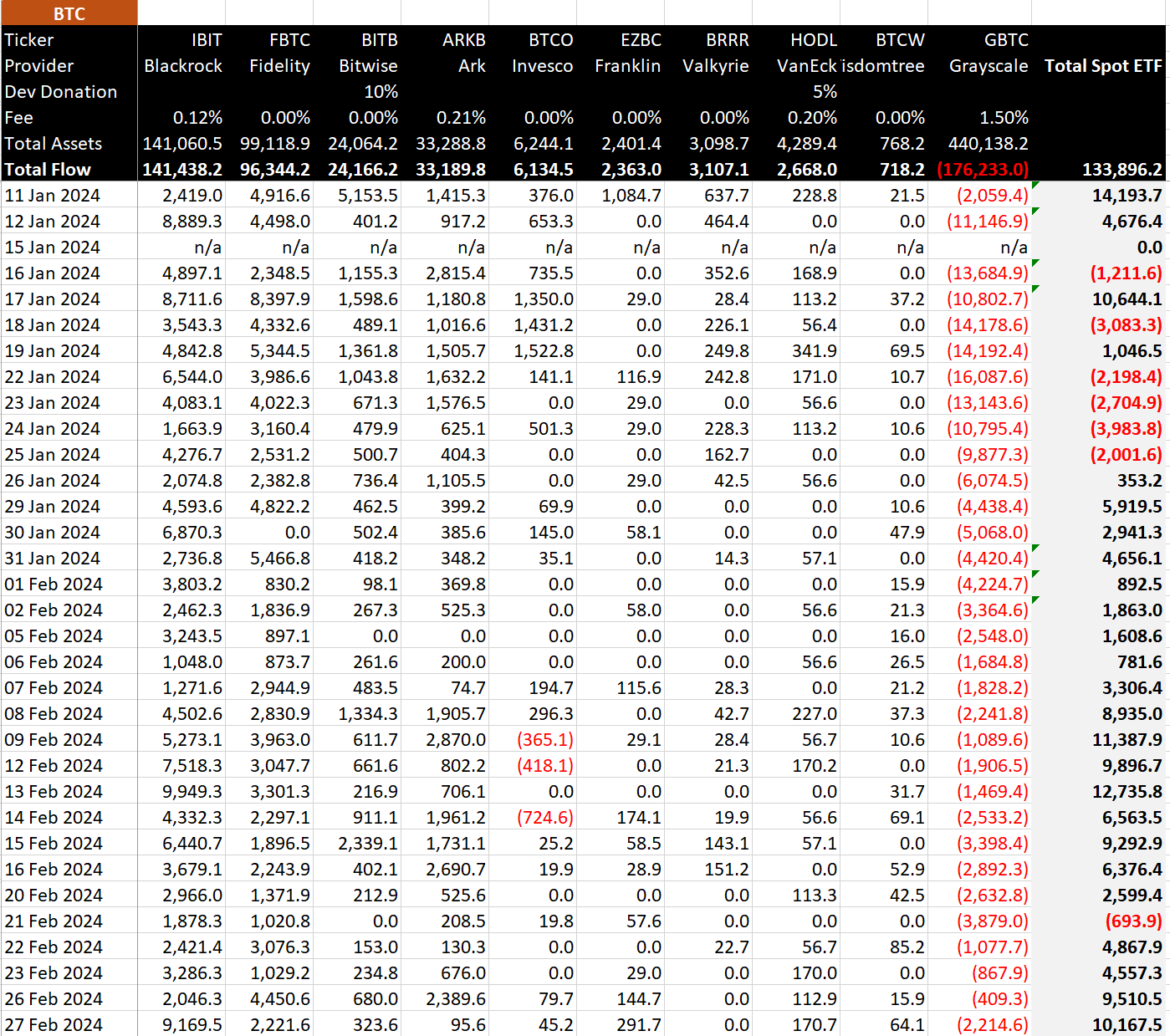

The Bitcoin ETFs are experiencing an impressive surge, with BitMEX data revealing the third-largest day of net inflows. The total net inflows hit around $577 million, which is the equivalent of roughly 10,168 BTC.

Following the fourth largest day of inflows documented by CryptoSlate the previous day, it’s evident the momentum is increasing, marking roughly a $55 million increase from the preceding day, according to BitMEX.

BitMEX data shows that BlackRock’s IBIT ETF recorded an unprecedented single-day inflow of $520 million, propelling it to a total of $6.5 billion in net inflows. Fidelity’s FBTC registered a sturdy $126 million in net inflows, thereby bringing its total to $4.5 billion.

BitMEX reports that the notable inflow into FBTC mirrored the outflow from GBTC, which experienced a sharp increase after three consecutive days of minor outflows, culminating in a total outflow of $7.6 billion.

The combined net inflow for the remaining seven ETFs reached an impressive roughly $56 million, according to BitMEX. Given that there are ten spot ETF products available, such a broad distribution of inflows is a positive indication of market forces.

Consequently, the overall net inflows stand at a staggering $6.7 billion, the equivalent of roughly 134,000 BTC, according to BitMEX.

The post BlackRock’s IBIT leads with record $520 million inflow, 3rd best day since launch appeared first on CryptoSlate.

Post a Comment