Bitcoin options data, particularly open interest and strike prices, is crucial for understanding the market’s expectations for future price movements.

Options are financial derivatives that give the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price (strike price) on or before a specific date. They’re a critical component of financial markets, providing insights into future price expectations and market sentiment.

Open interest represents the total number of outstanding options contracts that have not been settled. For Bitcoin options, a rising open interest indicates increased market participation and interest, showing that investors are positioning themselves for future price movements. Analyzing the distribution of strike prices can reveal where investors expect these prices to move.

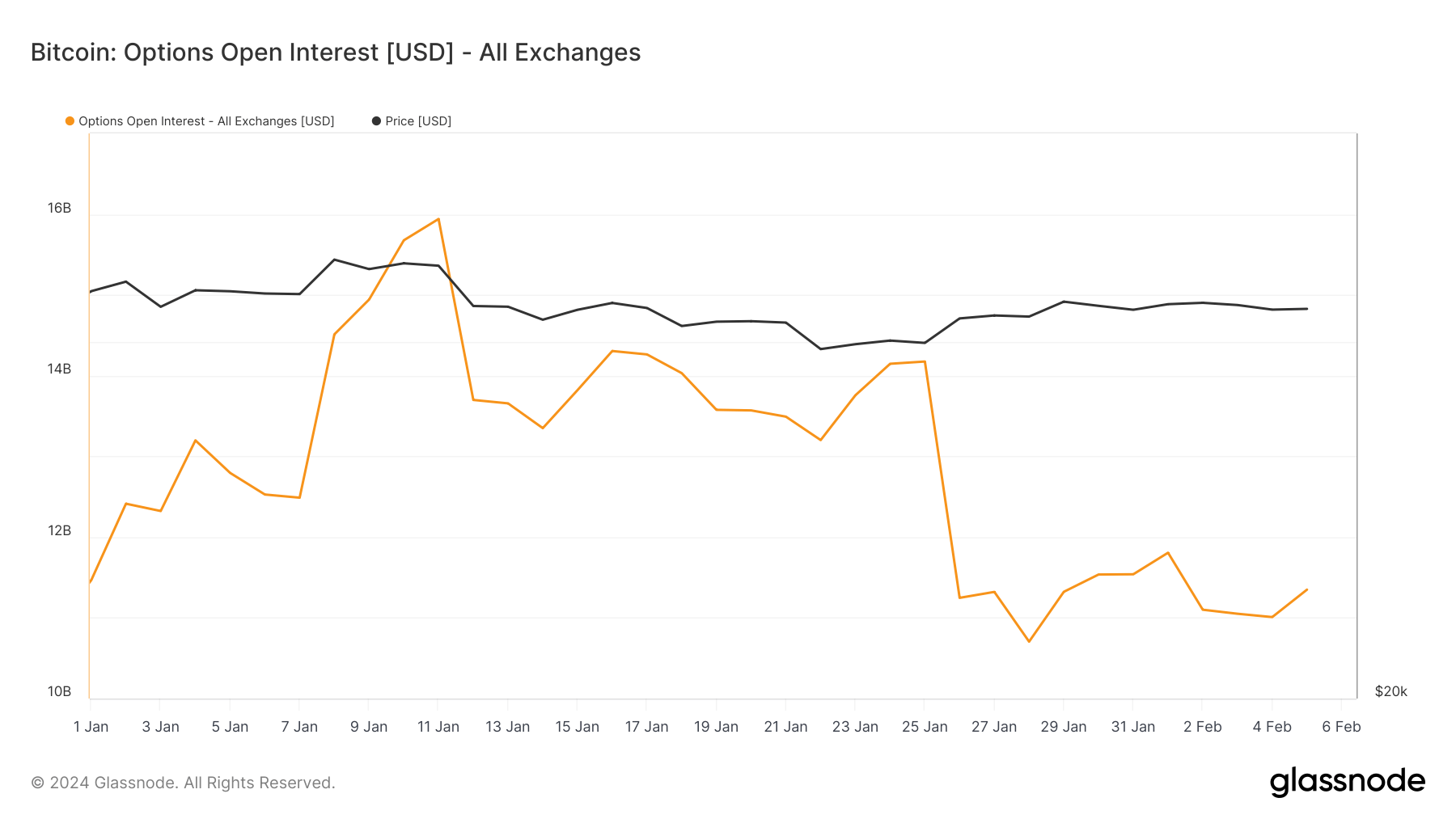

CryptoSlate’s analysis of Glassnode data showed a notable increase in open interest and trading volumes leading up to the approval of spot Bitcoin ETFs in the U.S. Open interest spiked to $15.94 billion on Jan. 11, the day ETFs began trading, up from $11.46 billion on Jan. 1.

This surge suggests increased market participation and potentially a bullish sentiment as investors might have sought to hedge new positions or speculate on the price direction post-ETF approval. However, the subsequent decline to $10.704 billion by Jan. 28 and a slight recovery to $11.348 billion by Feb. 5 indicates volatility and possibly a reevaluation of market positions as initial enthusiasm tempered.

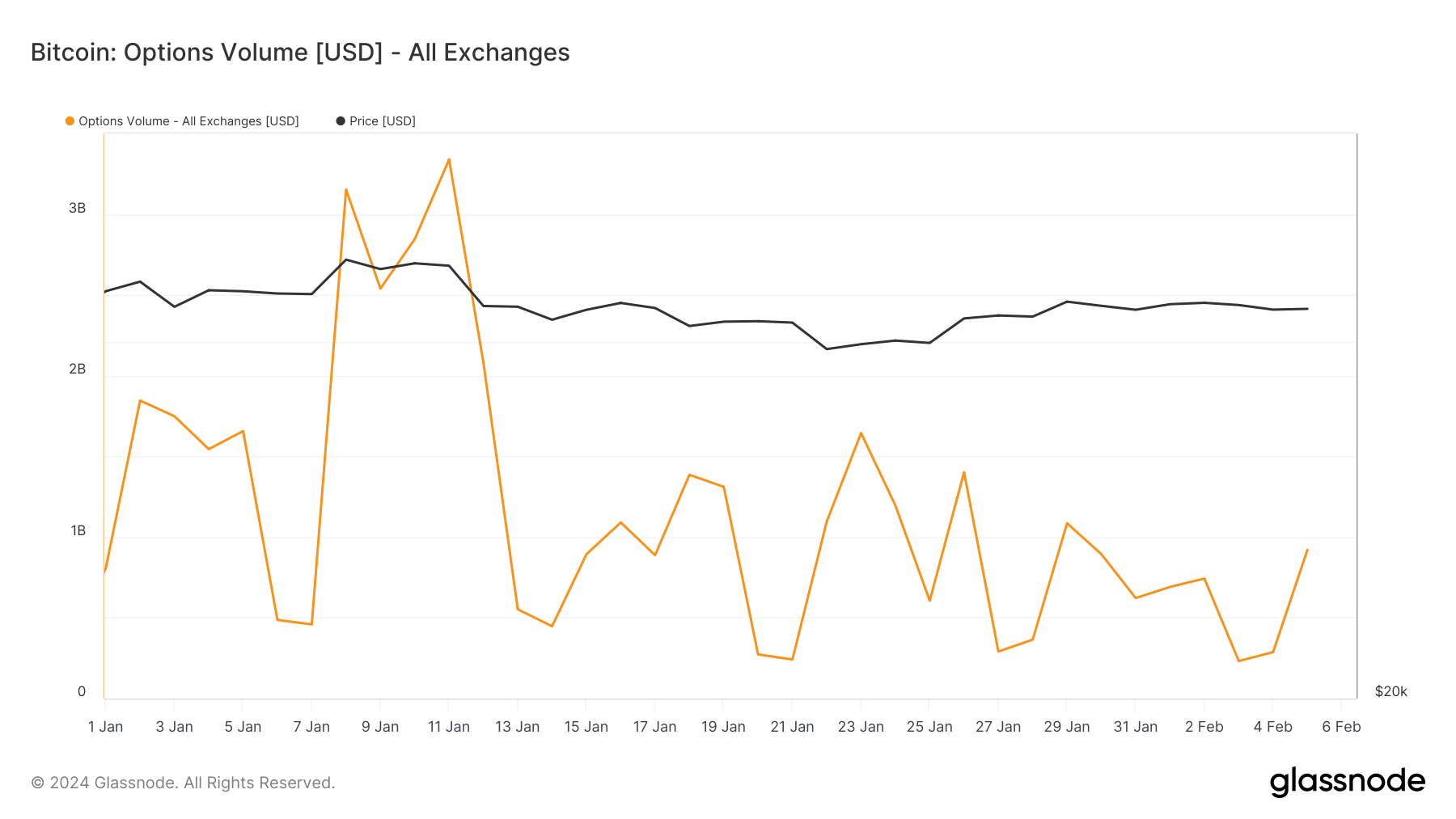

Trading volume peaked around the ETF launch, with a notable high of $3.338 billion on Jan. 11, which aligns with the spike in open interest. The fluctuation in volumes, particularly the drop to $364.900 million by Jan. 28, further underscores the market’s uncertainty and reassessment of strategies as the initial reactions to the ETF trading normalize.

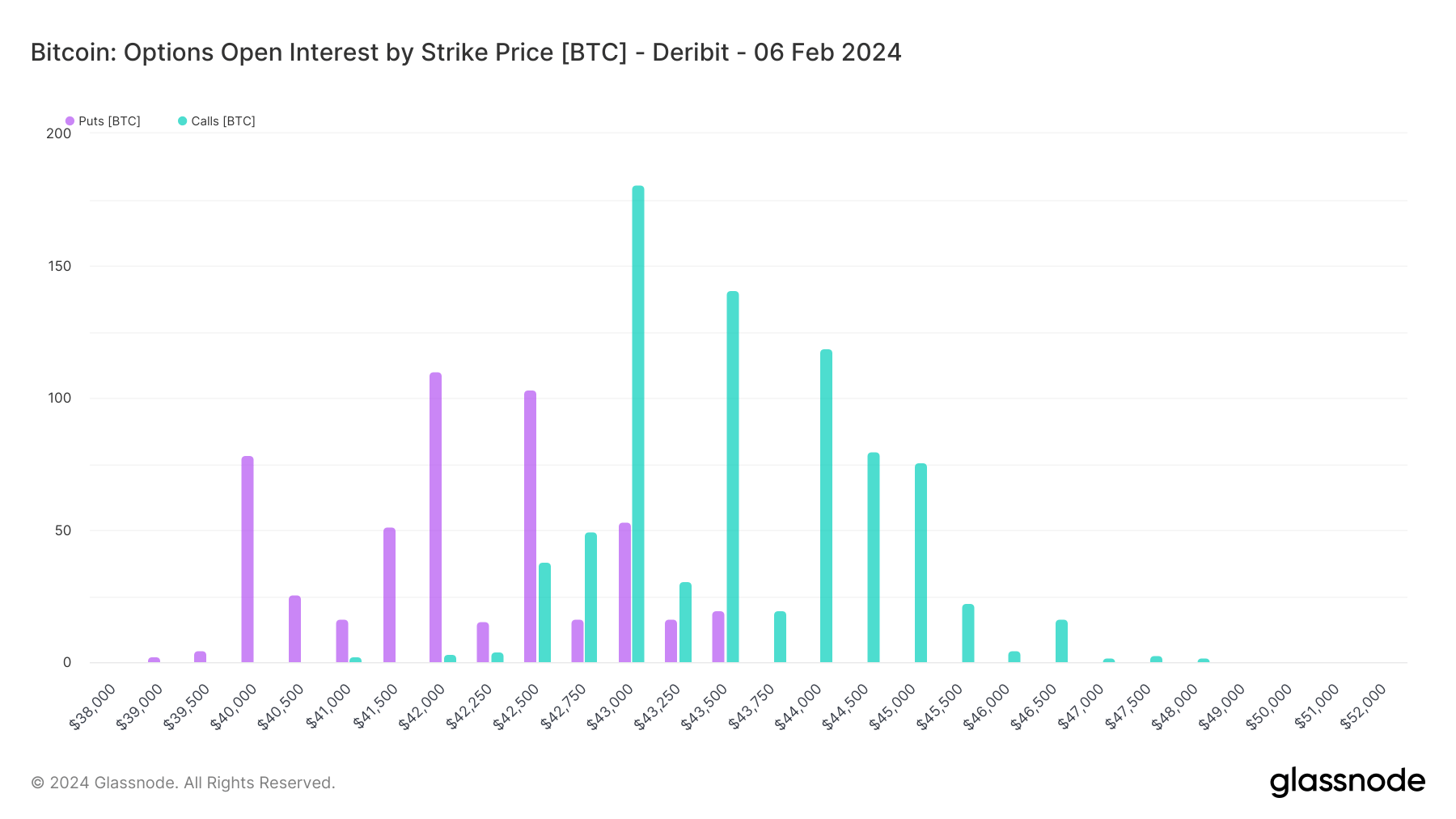

The distribution of open interest across strike prices on Deribit shows a diverse range of market expectations: near-term pessimism and long-term optimism. Specifically, for contracts expiring on Feb. 6, we observe a concentration of open interest in puts at lower strike prices and calls at slightly higher but not overly ambitious strike prices.

This pattern indicates a near-term bearish sentiment or a protective stance among options holders. They might be hedging against potential short-term downside risks or speculating on immediate price corrections.

The strike prices for Feb. 6, such as $43,000 and $43,500 for calls and notably lower volumes for puts, demonstrate a cautious optimism for a modest upward movement or stability in the near term.

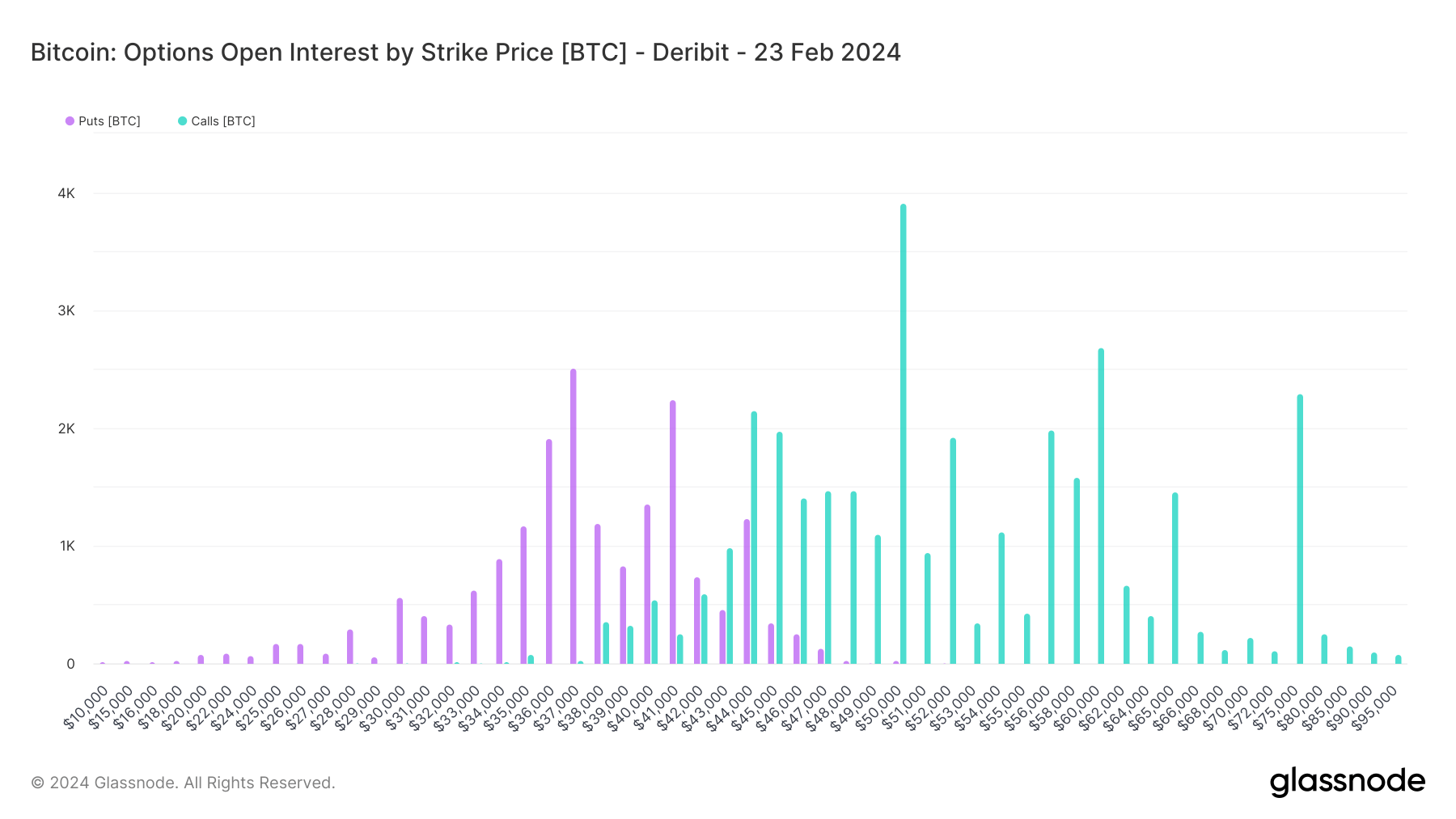

For contracts expiring on Feb. 23, the market sentiment shifts more dramatically towards optimism. The higher open interest in puts at lower strike prices ($37,000 and $41,000) aligns with a protective stance against significant price drops.

However, the substantial interest in calls at much higher strike prices ($50,000, $52,000, $60,000, and $75,000) underscores a long-term bullish outlook among investors. This suggests that despite near-term uncertainties or volatility, there is a strong belief in Bitcoin’s potential for a significant price increase by the end of the month.

The post Bitcoin options show long-term bullishness and near-term pessimism appeared first on CryptoSlate.

Post a Comment