Quick Take

Standard Chartered Bank’s recent report, dated Jan 8. 2024, provides an analytical perspective on a possible surge in Bitcoin’s price, contingent on the projected approval of spot ETFs by the US Securities and Exchange Commission (SEC).

The report draws a significant comparison with historical gold price escalations following the approval of gold ETFs, indicating the potential for an accelerated price increase for Bitcoin, given the expected rapid maturation of the Bitcoin ETF market.

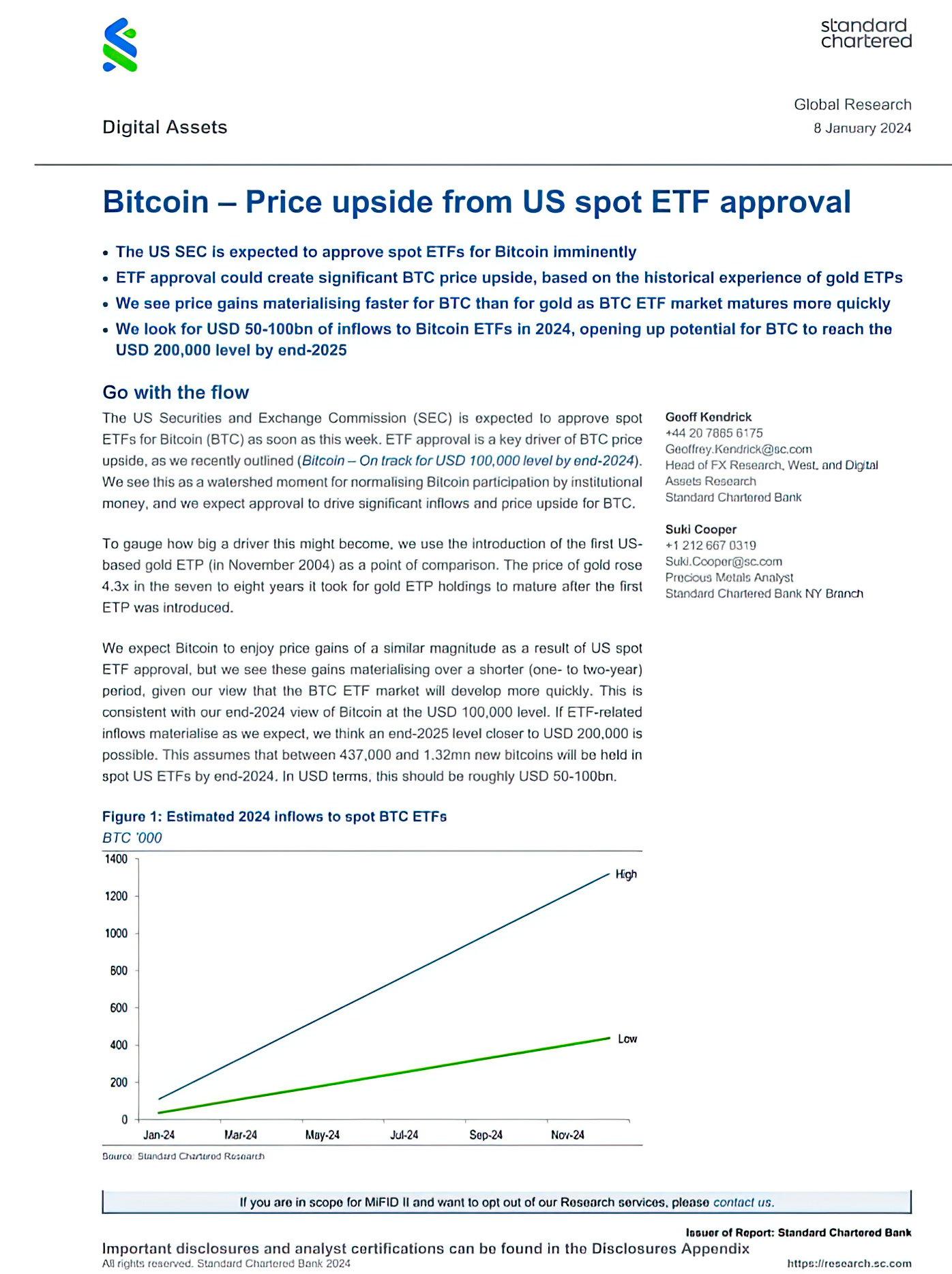

The analysis contends that Bitcoin ETFs could see inflows ranging from $50 to $100 billion by 2024. This influx is deemed a pivotal factor propelling Bitcoin’s price, possibly driving it to a staggering $200,000 by the end of 2025.

The report projects that between 437,000 and 1.32 million new bitcoins will be incorporated into spot US ETFs by 2024’s end, equating to approximately $50 to $100 billion of total inflows. This projection fortifies a bullish stance for Bitcoin’s price trajectory, contingent on the approval and subsequent inflows into the spot ETFs.

The post Standard Chartered: Possible $200k BTC by 2025 hinges on spot Bitcoin ETF approval appeared first on CryptoSlate.

Post a Comment