Quick Take

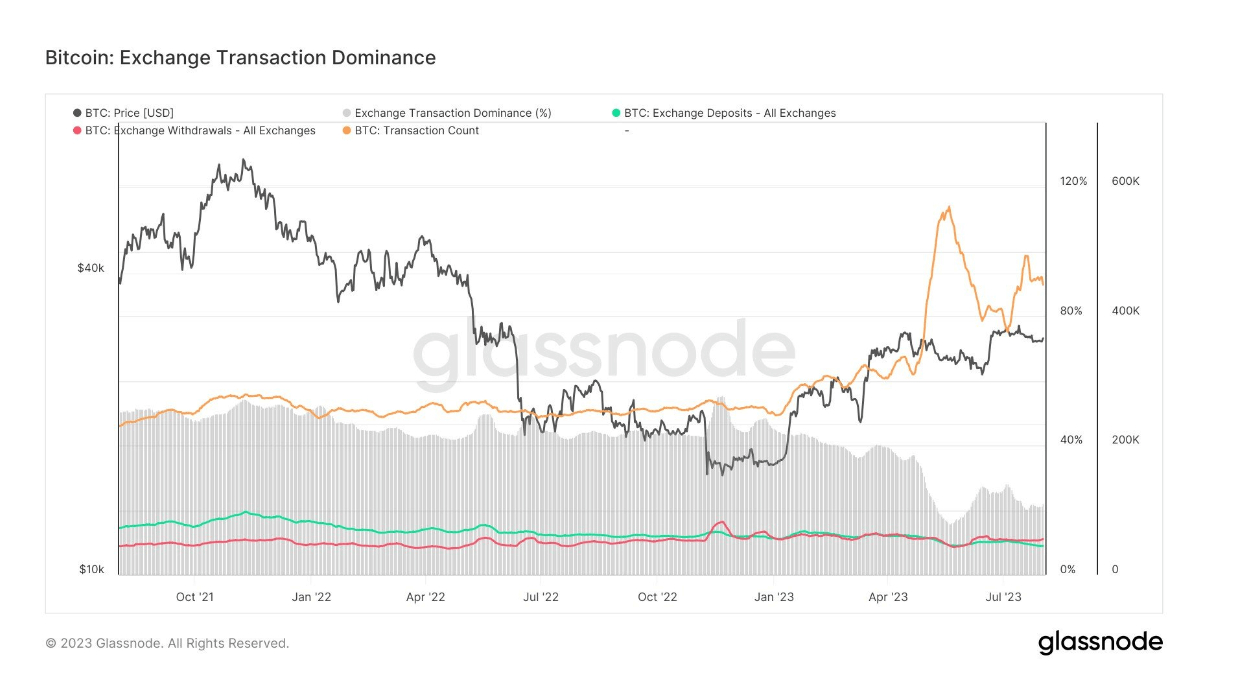

Recent statistics indicate a significant trend in the Bitcoin market, particularly a growing difference in transactions related to exchanges, specifically deposits and withdrawals. The data shows that Bitcoin withdrawals are around 55,000, surpassing the deposit count of approximately 44,000.

This increasing gap suggests a possible change in user behavior, which could have wider effects on the liquidity and market dynamics of the cryptocurrency. The Exchange Transaction Dominance, determined by the sum of deposits and withdrawals divided by the total transaction count, is a key indicator of this behavior. A rising dominance percentage implies a high level of exchange-related activity, which could influence Bitcoin’s price volatility and overall market sentiment.

The discrepancy between withdrawals and deposits might suggest that more users are opting to keep their Bitcoin instead of depositing it back into exchanges, possibly in expectation of future price increases. Conversely, a spike in deposits could indicate a sell-off, as users return their Bitcoin to the exchange.

The post Bitcoin holders resist exchanges as data points to potential price surge appeared first on CryptoSlate.

Post a Comment