The U.S. banking market recently underwent its annual stress test conducted by the Federal Reserve. This exercise, designed to evaluate the resilience of banks in the face of economic downturns, revealed a mixed bag of results that could have far-reaching implications for the cryptocurrency market, particularly Bitcoin.

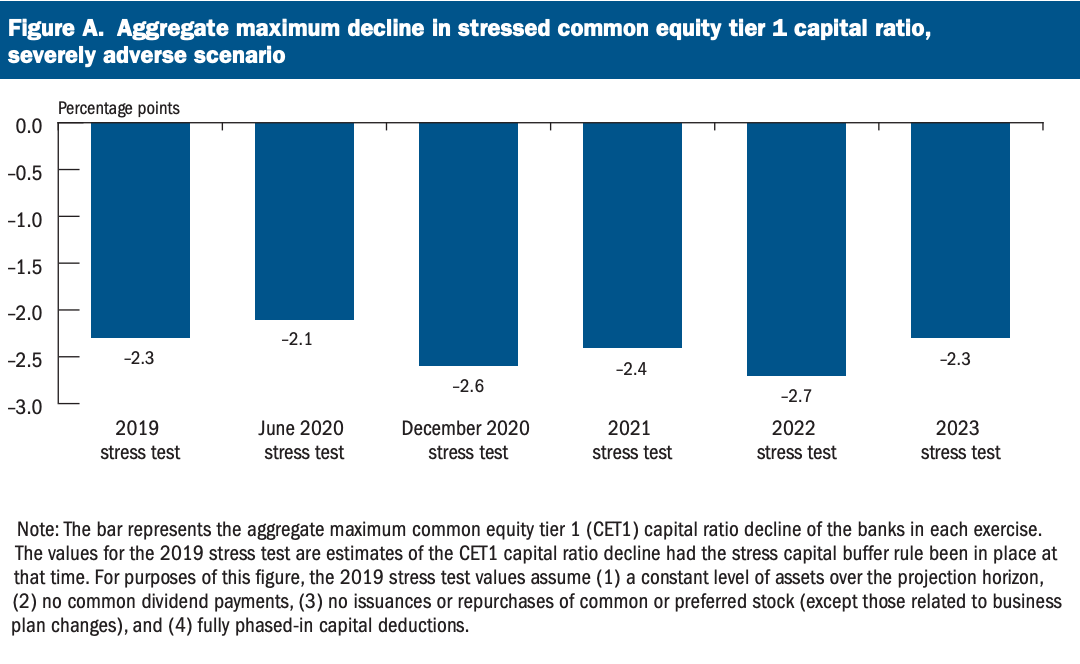

A stress test is a simulation used to assess how banks would fare during a financial crisis. The recent test showed that banks, on average, experienced a maximum drawdown on stressed capital of 2.3%. The 2.3% figure is the lowest seen in several years, indicating that banks are more resilient to financial stress now than they have been in the past.

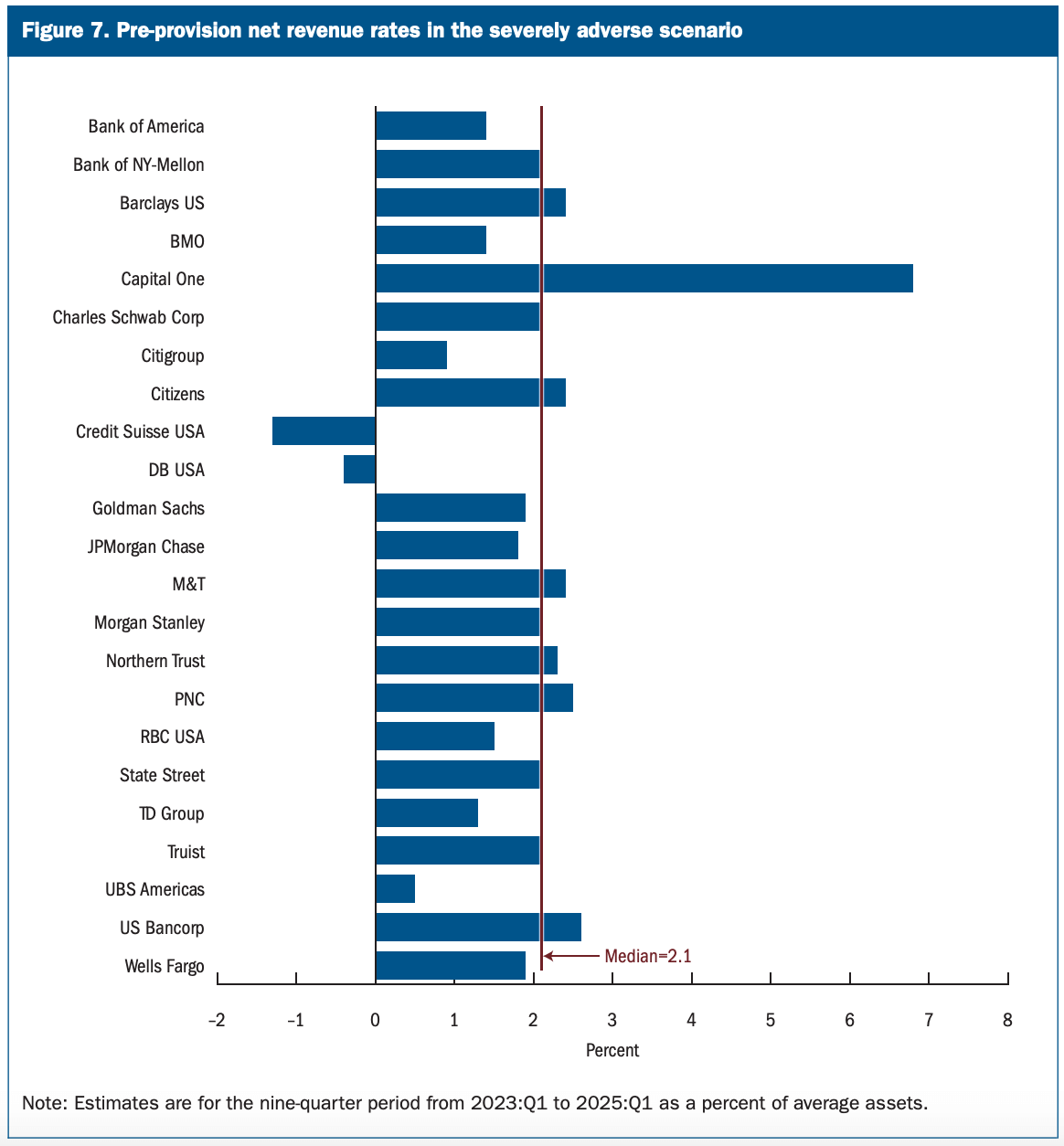

Some banks, notably Capital One Financial and U.S. Bancorp, saw a larger drawdown. This means they could face a higher Stress Capital Buffer (SCB), assuming dividends remain unchanged. The SCB is an additional amount of capital that a bank must hold to absorb losses and continue operations during financial stress.

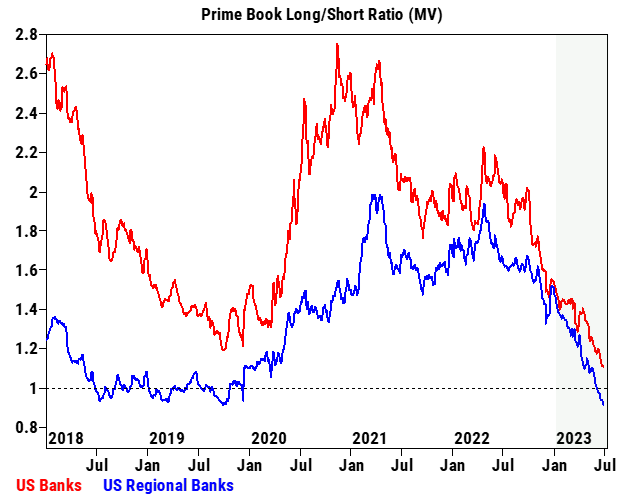

The mixed results from the stress test haven’t deterred hedge funds from actively shoring U.S. banks, especially regional banks. According to data from Goldman Sachs Prime Brokerage, regional banks are the most exposed to commercial real estate, a sector that has experienced high volatility since the COVID-19 pandemic.

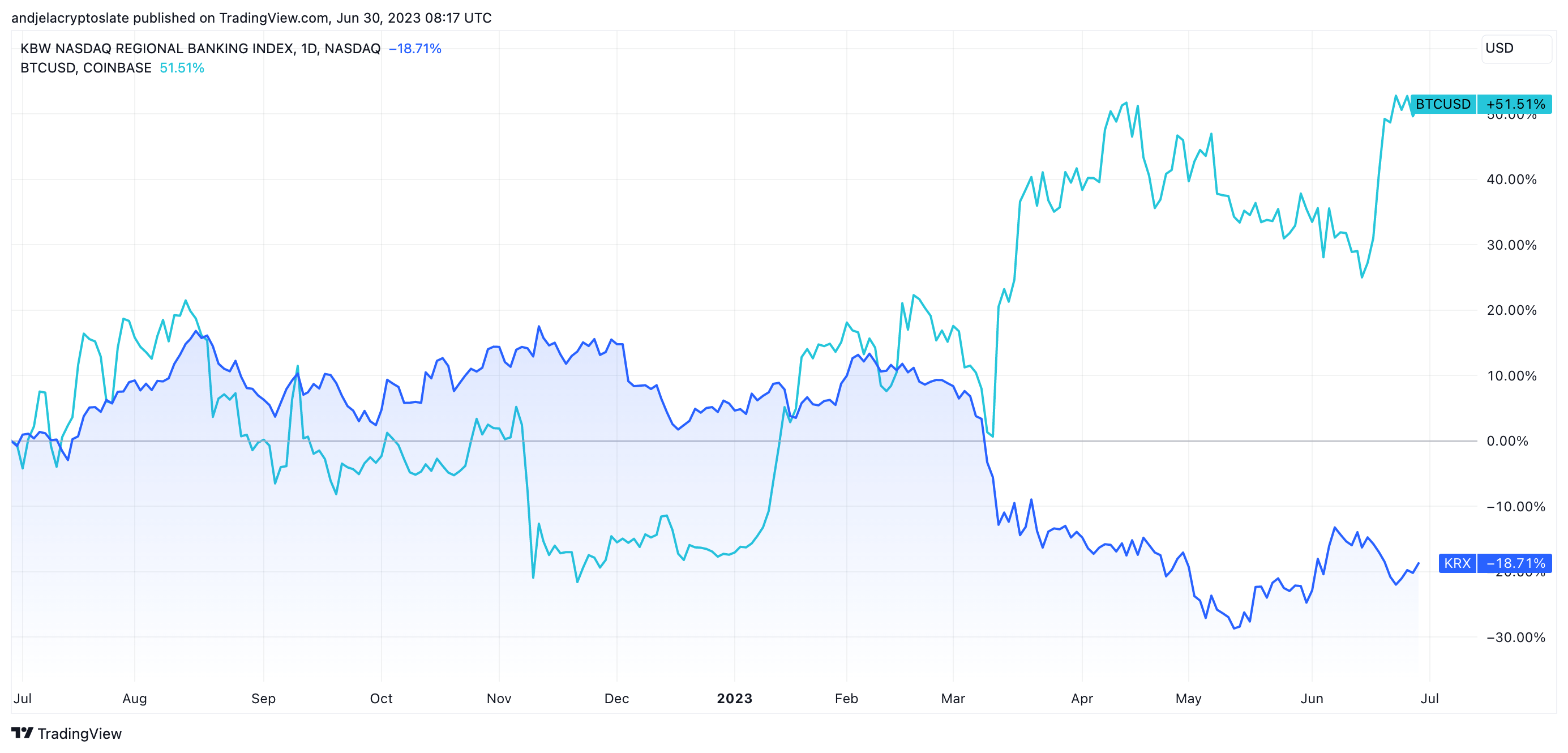

The banking industry’s health is crucial to Bitcoin and the broader cryptocurrency market.

Banks provide the infrastructure for fiat-to-crypto transactions, and their stability or instability can influence investor sentiment toward cryptocurrencies. Increased shorting of banks, if it leads to a downturn in the banking sector, could potentially drive investors towards Bitcoin as a safe haven asset.

If these shorts lead to significant market turbulence, it could create a risk-off environment that negatively impacts Bitcoin.

However, the crypto market has often thrived amidst traditional market instability. Bitcoin, in particular, has historically provided a hedge against traditional market fluctuations. Therefore, increased shorting of banks could potentially boost Bitcoin’s appeal as an alternative investment.

On the flip side, a destabilized banking sector could lead to tighter regulatory scrutiny and potential liquidity issues for cryptocurrencies. Banks facing significant stress may pull back on providing services to crypto businesses, affecting the ease of fiat-to-crypto transactions.

This could negatively impact Bitcoin in the short term, as the market could see weeks of low liquidity and increased selling pressure.

The post Why some hedge funds are shorting U.S. banks appeared first on CryptoSlate.

Post a Comment