Quick Take

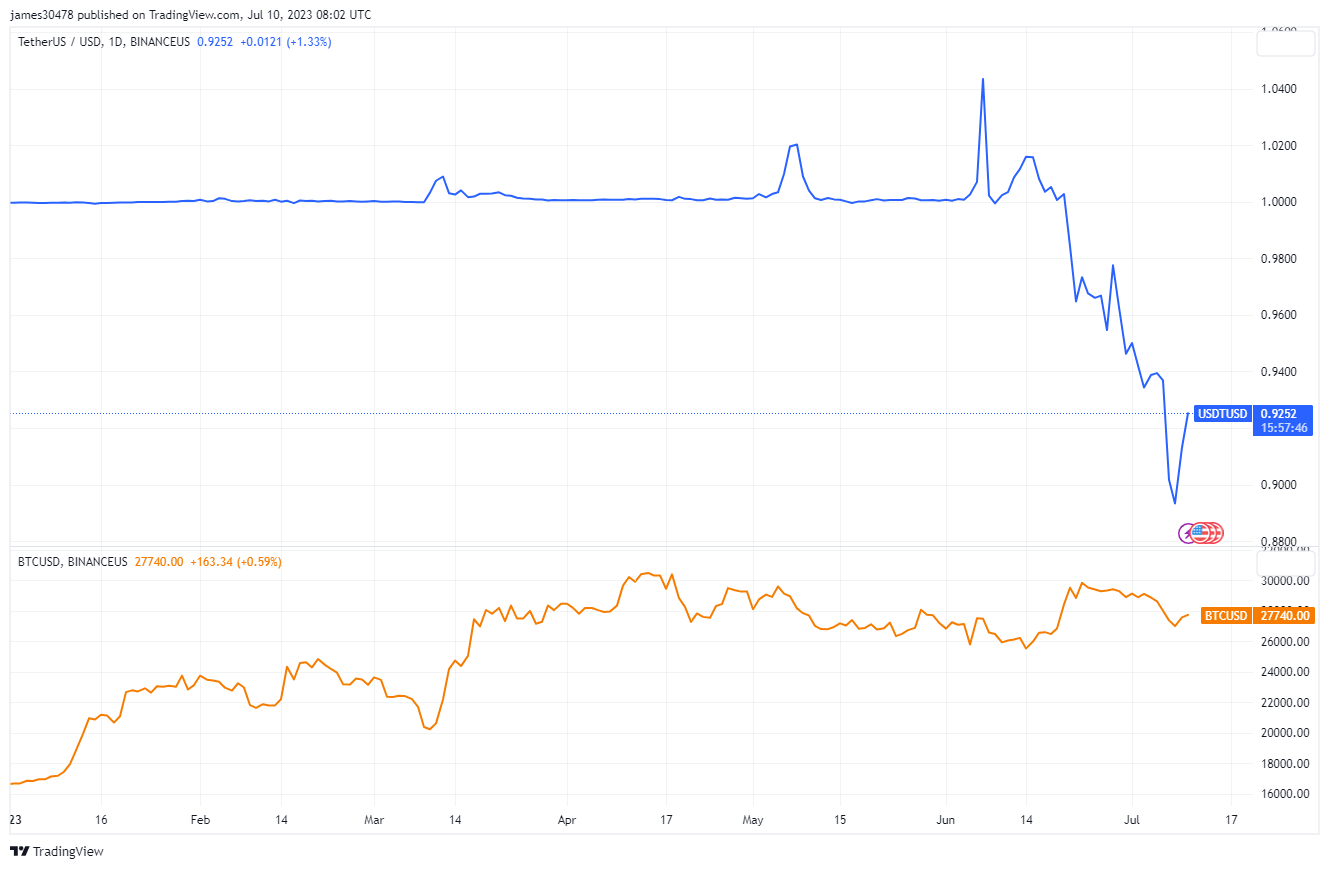

Over the past few weeks, there have been noticeable discrepancies in the asset prices on Binance U.S. This issue has come to the forefront due to the abnormal trading rates of Bitcoin (BTC) and Tether (USDT), two of the major cryptocurrencies on the platform.

The current trading price of Bitcoin on Binance U.S. is $27,700. This price point is unusual and represents a significant discount when compared to other platforms. In contrast, Bitcoin is trading at its expected spot price on Coinbase, indicating a specific pricing issue with Binance U.S.

Simultaneously, the stablecoin Tether (USDT) is trading at an unusually low price on Binance U.S. Presently, USDT is valued at $0.92, which deviates from the norm. As a stablecoin, USDT is typically pegged to the U.S. dollar at a 1:1 ratio, meaning that one USDT should be equivalent to $1. This current rate indicates a considerable discount.

Comparatively, the pricing mechanism on Coinbase remains consistent with the expected spot prices for both Bitcoin and USDT. This reaffirms the anomaly of Binance U.S.’s current pricing structure.

The ongoing discrepancy in the pricing mechanism on Binance U.S. is causing concern within the cryptocurrency community and highlights the need for further investigation into the matter.

The post Continued arbitrage in Binance U.S. asset pricing: Bitcoin and USDT appeared first on CryptoSlate.

Post a Comment