Quick Take

- CryptoSlate has discussed the possibility of de-dollarization and moving towards a unipolar world.

- These trends take decades to play out, but in such a scenario, Bitcoin and crypto may play some form of a new role in this ever-polarized world.

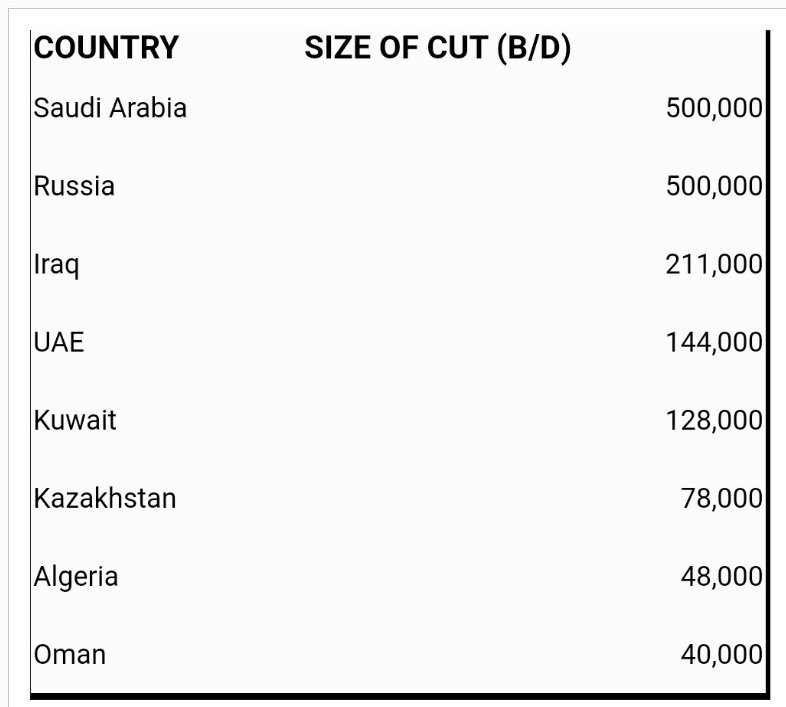

- OPEC+ announced they are cutting oil production by over 1 million barrels per day as oil surges in price.

- While Saudi Arabia and Russia are leading the charge, with over 500,000 barrels being cut daily.

- Bitcoin dropped as low as $27,600 on the OPEC production cuts.

The bearish case for the economy

- Typically, oil production costs are bearish for the economy. The three most recent largest oil production cuts came in 2000, 2008, and covid.

- If a recession were to proceed, this would be a deflationary driver for the economy, and a potential credit event could be on the horizon.

A case for de-dollarization

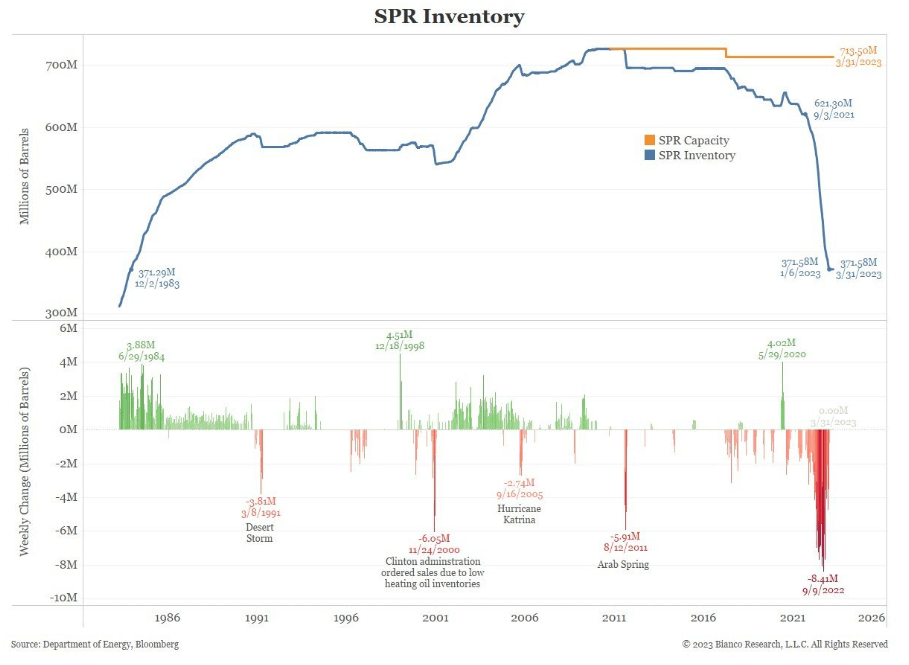

- While the U.S. drained the SPR inventory at the fastest rate ever and did not add to the inventory when prices were low, this opens up the Biden administration to further inflationary pressure.

- Furthermore, Saudi Arabia is set to adopt an economic strategy without the U.S. as tensions build with the Biden administration.

- Are economic producers starting to wake up to the fact that the west can continue to print currency to obtain scarce goods?

The post Bitcoin drops slightly following OPEC production cuts announcement appeared first on CryptoSlate.

إرسال تعليق