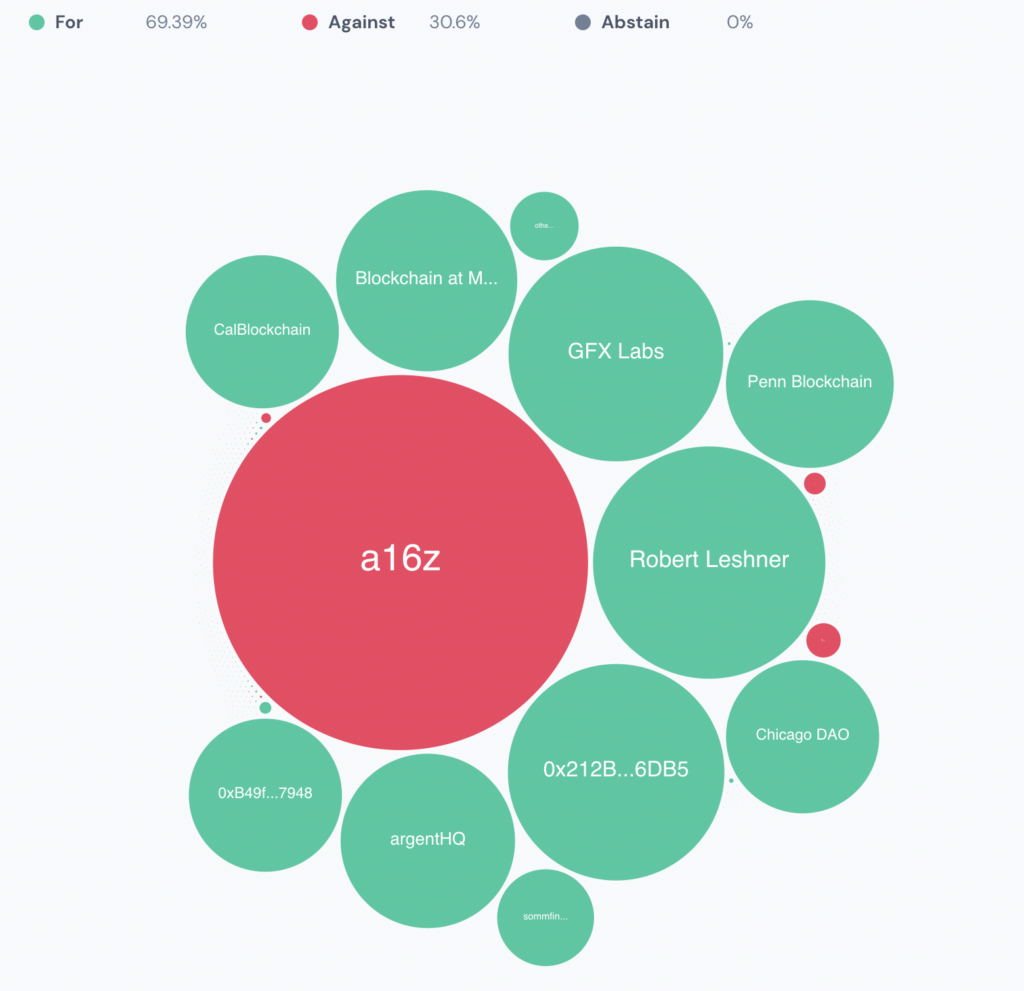

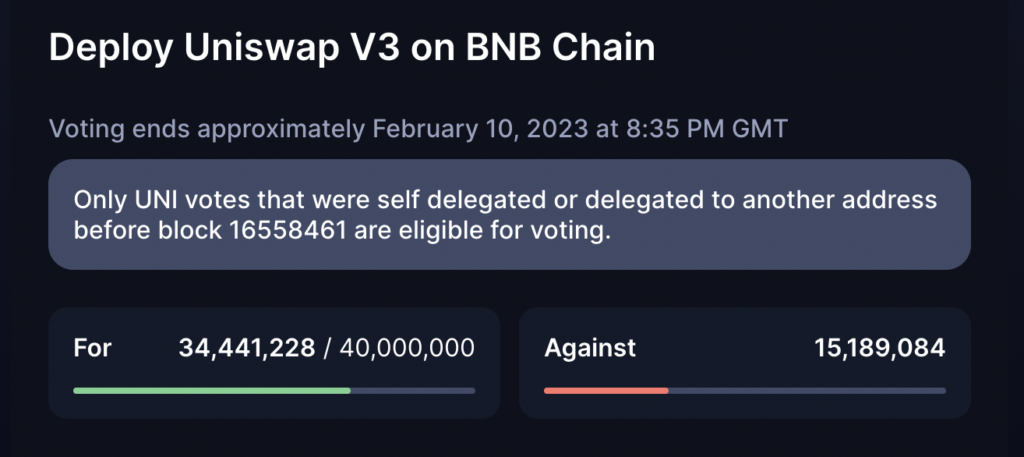

The proposal to deploy Uniswap V3 onto BNB Chain stalled this week as investment firm a16z voted against the integration due to a disagreement over the bridge provider. However, as of press time on Feb. 6, 70% of the vote is now in favor of the proposal.

a16z voted against the proposal to deploy onto BNB Chain as a proxy vote for the LayerZero bridge platform. However, a more recent a16z post stipulated it had instead voted to “reset the Binance Uniswap v3 deployment” until a further review of bridge options has been completed.

The Uniswap community has been vocally in favor of the BNB deployment as time is running out of a critical business license. However, the founder of 0xPlasma Labs, the company that made the initial BNB proposal, made a plea via the forums that it is “now or never” for the BNB deployment.

“Are we ready to lose now a market share of the protocol on many new chains forever, or will we take a chance to speed up the deployment with current conditions and solve a bridge dilemma with the next proposal, when the solution will be found?

For me, the answer is obvious: now or never.”

However, the governance drama has been further exacerbated as the level of a16z’s control over Uniswap was made more public. Representatives from the investment firm have been active on the Uniswap forum and clearly announced their position on the matter.

a16z Uniswap control

Roughly 15 million UNI tokens were used to vote in “toward LayerZero” due to the fact that it was unable to vote on the bridge proposal due to tokens being illiquid. a16z has, however, confirmed that it now has tokens sufficiently custodied to allow it to vote in future snapshots.

a16z reportedly holds roughly 4% of the UNI token supply, with 4% being the requirement for a quorum on governance proposals. Theoretically, a16z has enough tokens to pass a proposal on its own. However, this is still extremely unlikely that other token holders would allow this, given the public nature of all governance submissions.

Governance forum activity

The Uniswap governance forum has been highly active throughout the debate, with developers, community members, investors, and other representatives engaging in the discussion. Unlike legacy industries, DAO proposals often play out entirely in the public eye. From analyzing forum conversations, whether Uniswap will deploy onto BNB Chain has been playing out in a similar fashion and with extreme transparency.

Uniswap community member, Maneki, argued that competition from PancakeSwap should remain the highest priority.

“With PancakeSwap detailing plans to launch their V3 model on the same day as the expiration of Uniswap’s V3 BSL licence, it is crucial for the Uniswap governance to act swiftly and make a decision to remain competitive.”

Future of Uniswap V3 on BNB Chain

The voting for the BNB deployment had been close throughout. However, on Feb. 6, roughly 20 million votes were cast in favor of the proposal passing. Given that a16z publicly declared it voted against the proposal with 15 million UNI, only 189,084 other votes supported the rejection of the proposal.

Should a16z deploy the remaining 25 million UNI tokens under its ownership, it could attempt to force the proposal to fail. However, while 4% of the supply is impactful in a vote that, as of press time, only has a 5% participation rate from the community, considerably more holders could vote to push the deployment through.

Interestingly, only tokens delegated before UNI block 16558461 are eligible for voting. This is because Uniswap uses a delegation system similar to voter registration whereby holders must register their tokens to participate in the governance votes. Therefore, even though 95% of tokens have not voted, not all of the supply has been delegated to vote.

According to on-chain data, roughly 208 million UNI tokens have been delegated or self-delegated to be eligible to vote. Therefore, as of press time, there are still around 150 million votes eligible to vote.

The post Uniswap BNB deployment is ‘now or never’ as a16z disagrees on bridge solution appeared first on CryptoSlate.

Post a Comment