While most of the market focuses on Bitcoin’s price volatility, a much bigger problem seems to go unnoticed.

The centralization of Ethereum has been one of the hottest topics in the crypto industry since the network’s switch to Proof-of-Stake, with many critics warning about the dangers of such a high market cap cryptocurrency relying on only a handful of centralized validators.

Since the coveted mining ban in China, the centralization of the Bitcoin network mostly disappeared from mainstream discussions and became the focus of a niche group in the mining sphere.

However, Bitcoin’s centralization is a problem that concerns the entire market, especially now when only two mining pools produce the majority of its blocks.

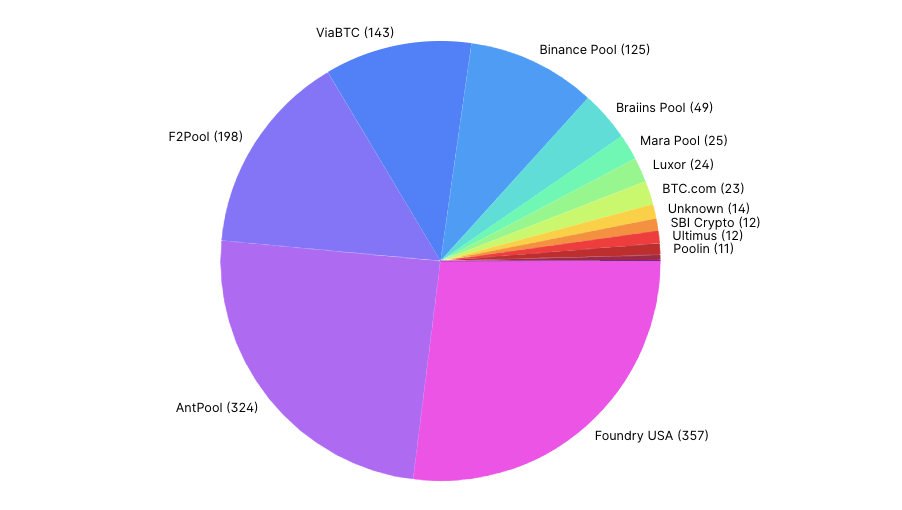

CryptoSlate looked at Bitcoin’s global hash rate distribution and found that more than half of it came from Foundry USA and Antpool.

The two pools mined over a quarter of Bitcoin blocks in the past ten days each. Since mid-December, Foundry USA mined 357 blocks, while Antpool mined 325. Foundry’s block production accounted for 26.98% of the network, while Antpool was responsible for just under 24.5% of the total block production.

Antpool has been at the forefront of Bitcoin mining for years and produced almost 14% of the blocks mined in the past three years. On the other hand, Foundry is a relatively new name in the mining space. However, it quickly rose to become one of the top ten pools by hash rate, accounting for 3.2% of the blocks mined in the past year.

A deeper look at Antpool and Foundry USA shows an alarming level of centralization — and a web of interconnected companies that effectively own half of the network.

Foundry — DCG’s mining behemoth

It took less than two years for Foundry USA to become a force to be reckoned with in the Bitcoin mining space. The mining pool is owned and operated by the eponymous Foundry, a company Digital Currency Group (DCG) created in 2019.

By late summer 2020, Foundry was already among the largest Bitcoin miners in North America. Aside from mining, the company offered equipment financing and procurement. By the end of 2020, Foundry helped procure half of all the Bitcoin mining hardware delivered to North America.

Foundry’s massive success as an equipment procurer and miner directly results from DCG’s influence in the crypto industry.

The venture capital firm is one of the space’s largest and most active investors, backing more than 160 crypto companies in over 30 countries. DCG’s portfolio is a registry of the industry’s biggest players — Blockchain.com, Blockstream, Chainalysis, Circle, Coinbase, CoinDesk, Genesis, Grayscale, Kraken, Ledger, Lightning Network, Ripple, Silvergate, and dozens more.

Foundry is its wholly-owned subsidiary that acts as a one-stop shop for all of these companies’ mining needs. The rapid growth in Foundry USA’s hash rate led some to speculate that DCG’s companies were contractually obligated to do all of their mining through Foundry’s pool. However, it’s important to note that neither DCG nor any companies in its portfolio confirmed this.

The mining ban instated in China last year helped as well.

Forced to leave China’s abundant and cheap hydropower, miners were looking for alternative locations offering at least a fraction of their profit and a more welcoming regulatory environment.

The U.S. presented as a perfect relocation spot, offering miners a wide selection of locations and power sources. And having a mining pool as large as Foundry USA at their doorstep certainly didn’t hurt.

Antpool — Bitmain’s monopoly

Founded in 2014, Antpool is one of the oldest operating mining pools on the market. Frequently accounting for over a quarter of the global hash rate, Antpool has almost never left the top ten largest mining pools.

The pool’s success is its perfect vertical integration — it is owned and operated by Bitmain, the world’s largest mining hardware manufacturer. The company behind the Antminer series has supplied its pool with the newest and most efficient Bitcoin hashers, helping it stay profitable even in the coldest crypto winters.

Bitmain’s influence over the global crypto market has led many to speculate that the company was obligating its large buyers to mine with Antpool. With both Bitmain and Antpool having headquarters in China, many also worry about the country’s influence over such a large portion of Bitcoin’s hash rate.

The corporatization of crypto mining

It’s important to note that a mining pool differs from a private mining operation. Unlike a private miner, a pool represents the joint hash rate of many machines owned by various entities.

Owners of mining machines, or hashers, split the profits generated by the mining pool according to the size of their contribution.

That Foundry USA accounts for a quarter of the Bitcoin hash rate doesn’t mean that DCG owns every machine that produced it.

However, Foundry provides the foundation and the roof for its clients’ mining operations. The company’s weaknesses could shake up a significant portion of the Bitcoin network and leave thousands of smaller miners and machines fending for themselves if it were to shut down.

The same can be applied to Antpool.

The rate of centralization these two entities imposed on the industry becomes even greater when looking beyond just Bitcoin. Antpool has pools for other cryptocurrencies as well — Litecoin (LTC), ZCash (ZEC), Bitcoin Cash (BCH), Ethereum Classic (ETC), and Dash (DASH), just to name a few.

Foundry offers enterprise staking support for Ethereum (ETH), Solana (SOL), Polkadot (DOT), Avalanche (AVAX), and Cosmos (ATOM). The company doesn’t disclose the number of assets it manages.

The post The centralization of Bitcoin: Behind the two mining pools controlling 51% of the global hash rate appeared first on CryptoSlate.

Post a Comment